It sounds like Strathcona demanded public disclosure of it’s preliminary results. That Pretium refused is probably why they quit. Pretium goes on to say that Strathcona had no grounds for “asserting” these “recommendations” since they had grossly insufficient data.

[box type=”info” align=”aligncenter” ]Disclaimer: This is an editorial review of a public press release and may include opinions or points of view that may not be shared by the owners of geologyforinvestors.com or the companies mentioned in the release. The editorial comments are highlighted so as to be easily separated from the release text. Please view the full release here.[/box]

Results from Processing 426585E Cross-Cut

The preliminary mill results from the processing of the 2,167 tonnes of bulk sample material contained in the 426585E cross-cut are presented in Table 1 below:

Table 1: Cross-cut 426585E Preliminary Mill Results

| Tonnes Milled(Dry) |

Gold Ounces GravityConcentrate |

Gold Ounces FlotationConcentrate |

Gold OuncesTailings |

Total Contained Gold Ounces |

Total Contained Silver Ounces |

| 2,167 | 94 | 174 | 13 | 281 | 532 |

| Notes: Preliminary mill results are provided by Strategic Minerals LLC, operator of the mill, and are subject to final establishment of weights and assays and settlement. | |||||

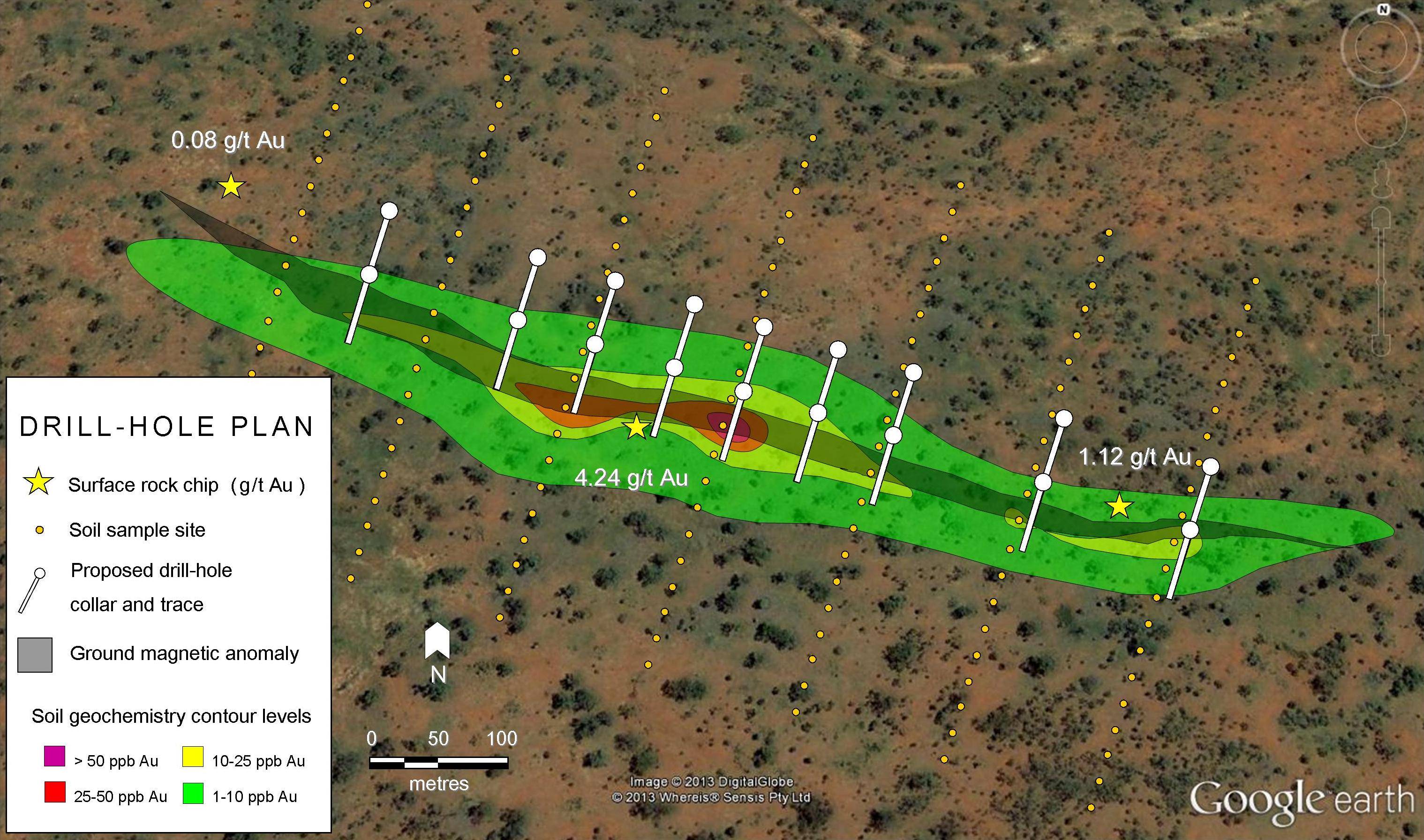

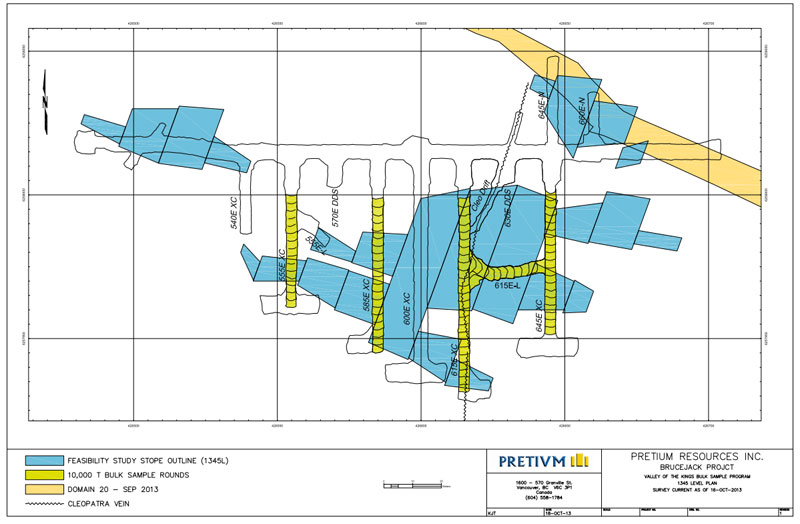

[box type=”note” align=”aligncenter” ]These preliminary results represent about 1/5th of the total bulk sample that Pretium has planned. The location of the sample is show on the map below. The location of the sample is neither in the very low grade, nor is it the very high grade “Cleopatra” zone. We’ve included a diagram of the bulk samples locations below. The sample they are reporting on is the second from the left.

For comparison, 281 gold Ounces in a 2,167 tonne sample equates to approximately 4.03 g/t. This is significantly below the 13.6 g/t probable reserve reported by Pretium for the Valley of the Kings Zone, but closer to the proven reserves of 5.7 g/t for the mine. According to Pretium, they were expecting a grade of 4.6 g/t for this particular zone.[/box]

Processing Continuing on Track

The processing of the excavated 10,000-tonne bulk sample is proceeding as planned at a rate of approximately 1,000 tonnes per week to produce gold/silver gravity and flotation concentrates. Processing of the 426555E cross-cut is underway and is expected to be completed this week, followed by the 426645E cross-cut. A total of 4,000 ounces of gold were projected to be produced in total from the material excavated for the Program.

The amount of gold produced from the entire 10,000-tonne bulk sample will be used to reconcile the Valley of the Kings November 2012 Mineral Resource estimate (the “November 2012 Mineral Resource Estimate”), prepared by Snowden Mining Industry Consultants (“Snowden”). Snowden, one of the world’s leading providers of technical consulting services, independent advice and technology solutions to the mining sector, was engaged by Pretivm to produce the November 2012 Mineral Resource Estimate and review and sign-off on the milling and processing component of the Program.

Sample Tower Results for 426585E Cross-Cut

Prior to resigning from the Program, Strathcona Mineral Services Ltd (“Strathcona”) provided to Pretivm preliminary assay results from the sample tower that included those for the 426585E cross-cut, which averaged 2.08 grams per tonne gold. The assay results from the sample tower represent approximately 0.01% of the material excavated from the 426585E cross-cut. Based on a dry weight for the 426585E cross-cut of 2,167 tonnes, a total of 145 ounces of gold were estimated by Pretivm to be contained within the 426585E cross-cut using the preliminary assay results from the sample tower. Consultants from Strathcona, also one of the world’s leading providers of consulting services to the mining industry in Canada and internationally, were engaged in late 2012 as independent Qualified Persons to oversee the 10,000-tonne bulk sample and produce a report at the conclusion of the Program once all data, including the assay results from the sample tower and the 16,789 meters of completed underground drilling, had been compiled.

Preliminary figures from the processing of the 426585E cross-cut show the contained metal included 281 ounces of gold. It is the opinion of both Pretivm and Snowden that there is a significant difference in the contained gold estimated by the selective sampling of the 426585E cross-cut by the sample tower and the actual contained gold determined by milling the total 2,167 tonnes of material excavated from the 426585E cross-cut (there is 94% more gold produced from the mill than was estimated from the sample tower results for the same material). A related discussion on the sample tower component of the Program, Strathcona’s stated reasons for withdrawing from the Program, and Snowden’s response is set out below.

[box type=”note” align=”aligncenter” ]In order to determine the grade of a large bulk sample, smaller pieces are randomly chosen and assayed as a “representative” sub-sample. This is somewhat like a phone survey which calls 1,000 people in order to determine the collective opinion of 10 million people. It is a typical and accepted practise. Based on a this sub-sample, Strathcona estimated the grade for larger bulk sample to be 2.08 g/t and concluded that the project was not economic and should not continue. More detail on their reasoning is discussed below.[/box]

Cross-cut 426585E in Relationship to the November 2012 Valley of the Kings Mineral Resource Estimate

Snowden has advised Pretivm that the November 2012 Mineral Resource estimate is a bulk mining estimate, and that the grade of no single block should be used as a standalone estimate. As a result, the actual contained gold within the entire 10,000-tonne bulk sample determined by processing needs to be reconciled against the contained gold predicted for the 10,000-tonne bulk sample using the estimated gold grade for the bulk sample area from the November 2012 Mineral Resource Estimate, which is estimated to be approximately 4,000 ounces.

Cross-cut 426585E in Relationship to the Mineable Stopes Defined by the Feasibility Study

A net smelter returns royalty (“NSR”) cut-off grade of $180/tonne of ore was used to define the mineral reserves for the Brucejack Project Feasibility Study (see Pretivm’s news release dated June 11, 2013) at base case prices of $1,350 gold, $20 silver and US$:C$ at par. The $180 NSR provided a minimum $23.54operating margin for Feasibility Study operating costs of C$156.46/tonne milled.

The 426585E cross-cut excavation cuts through portions of three Feasibility Study stopes (the “426585E Stopes”). The tonnage processed and the grade of the gold and silver produced from the material excavated from the 426585E development going through these stopes was estimated to be 1,451 tonnes grading 4.6 grams per tonne gold and 6.8 grams per tonne silver, based on the preliminary mill results estimated for the 426585E Stopes. The value of the gold and silver produced from the 426585E Stopes was estimated to be $204.03/tonne at Feasibility Study base case metal prices providing an operating margin of$47.57/tonne over Feasibility Study operating costs.

[box type=”note” align=”aligncenter” ]Snowden Mining Industry Consultants, who were hired to produce the initial resource estimate and sign-off on the milling and processing have disagreed with Strathcona’s approach and insist that the entire bulk sample needs to be complete before conclusions can be drawn. The publishing of these preliminary results from the initial 2,167 tonne sample is designed to demonstrate Snowden’s position is correct and that Strathcona’s sample program was flawed. These results show that Strathcona was wrong by half since the assays are nearly double Strathcona’s estimates.[/box]

Strathcona’s Withdrawal from the Program

As stated above, consultants from Strathcona were engaged in late 2012 as independent Qualified Persons to oversee the 10,000-tonne bulk sample and produce a report at the conclusion of the Program once all data, including the assay results from sample tower and the 16,789 meters of completed underground drilling, had been compiled. The report was expected to reconcile the assay results from the sample tower against a local resource estimate prepared by Snowden based on the Program drilling, which would provide an empirical grade prediction variance for a stope-sized tonnage that could be related to and used for resource classification. Strathcona’s report on the Program was expected in early 2014.

Strathcona withdrew from the Program on October 8, 2013 before any results from the processing of the bulk sample were available. In withdrawing from the Program, Strathcona advised Pretivm that “…there are no valid gold mineral resources for the VOK Zone, and without mineral resources there can be no mineral reserves, and without mineral reserves there can be no basis for a Feasibility Study.” They also advised that “…statements included in all recent press releases [by Pretivm] about probable mineral reserves and future gold production [from the Valley of the Kings zone] over a 22-year mine life are erroneous and misleading.” Snowden maintains its stance that the November 2012 Mineral Resource Estimate remains valid, and has taken steps to involve a third party peer review in its up-coming mineral resource update.

[box type=”note” align=”aligncenter” ]Strathcona has not minced words here. They have basically accused Pretium of having nothing and lying to everyone. Strathcona is a widely respected consultant who is perhaps best know for exposing the Bre-X fraud. Their words carry a lot of weight and are no doubt responsible for the market’s recent lack of faith in Pretium. As a result Pretium is now faced with a crisis of trust. Pretium is meeting this head-on by publishing Strathcona’s statements and trying to demonstrate through the assay data that Strathcona was in error. [/box]

In addition, Strathcona advised that, “The infrequent high-grade intercepts reported in the press releases have been shown in the underground exposures of the bulk sample program to usually be of very narrow width (0.5 meters) and associated with narrow geological structures that occasionally have mineable continuity as in the case of the Cleopatra Vein.” The results from Valley of the Kings Program drilling have been, from the outset, consistent with results from prior exploration drilling in the Valley of the Kings. Drilling has frequently intersected extreme grade mineralization over narrow widths, with 47 intersections grading greater than 1,000 grams of gold per tonne from underground drilling (on average there is one in every 550 meters of 2013 drilling) and 125 intersections in total to date grading greater than 1,000 grams of gold per tonne for the Valley of the Kings. The Program was initiated, amongst other reasons, to determine the bulk mineability of the Valley of the Kings mineralization. These reasons and the form of mineralization were discussed with Strathcona prior to their engagement.

When it withdrew, Strathcona advised Pretium that it had previously asserted similar views critiquing the Snowden resource model for the Valley of the Kings, accompanied with “recommendations” for public disclosure of the preliminary bulk sample data supporting their conclusions. At one point, these assertions, conclusions and “recommendations” were made on the basis of approximately 20% of the underground drilling results, no assay results from the sample tower and no results from production.

[box type=”note” align=”aligncenter” ]The plot thickens! It sounds like Strathcona demanded public disclosure of it’s preliminary results. That Pretium refused is probably why they quit. Pretium goes on to say that Strathcona had no grounds for “asserting” these “recommendations” since they had grossly insufficient data. It may be just me but I think the tone of this release is meant to paint Strathcona as somewhat rash and immature.[/box]

Snowden has consistently and repeatedly advised in response to all comments from Strathcona that the true test of the resource estimate will only come from the reconciliation results between the ultimate grade of the bulk sample (as defined by produced metal and metal accounting) and the grade of the resource estimate for the same volume. Strathcona resigned before Snowden had an opportunity to formally respond to their assertions.

Both Pretivm’s management and Snowden share a number of significant concerns with respect to Strathcona’s conclusions. They contend that the Strathcona conclusions are based on: (a) the interpretation of preliminary data, (b) the interpretation of too few data, and (c) the incorrect interpretation and application of preliminary local data for comparison to the resource estimate model. Pretivm management and Snowden also share significant concerns that the sampling tower approach for the Valley of the Kings deposit may be flawed.

Snowden’s Response

Given the heterogeneous nature of the Valley of the Kings mineralization, Snowden has consistently advised Pretivm that the entire 10,000-tonne bulk sample needs to be processed prior to completing a reconciliation that can be considered robust. Dr. Simon Dominy of Snowden is reviewing the sample theory underlying Strathcona’s sampling protocols for the sample tower and will be providing a formal expert opinion to Pretivm. Dr. Dominy has noted that he concurs with the current approach of submitting the entire bulk sample (as batches) for full processing through the Montana plant, and has advised that such an approach is always the best route to fully evaluate bulk samples and/or trial mining parcels.

Dr. Dominy has provided a preliminary report to Pretivm that covers several areas of consideration for the evaluation of the design of the sampling Program. This includes the appropriate application of mineralisation characterization study, and the difficulties in achieving representative samples in a high-nugget coarse gold environment.

Dr. Dominy is a dual qualified mining geologist-engineer with 25 years of experience, across mine operations, academic research and consulting. He has an extensive global track-record of auditing, designing and managing gold sampling and assaying programmes. He is a leader in the sampling of coarse gold deposits, and consulted, lectured and published widely on the topic. Recent sampling assignments have included: audits and reviews; integrated studies of ore characterisation, gold deportment and metallurgical testing; sample size determination; sample protocol design and optimisation; the application of the Theory of Sampling; metallurgical plant sampling; metallurgical sampling; and grade control systems. He also has extensive practical experience in surface and underground bulk sampling/trial mining programme design, planning, management and interpretation.

[box type=”note” align=”aligncenter” ]The Snowden Group are no dummies either. Nor are they a fly-by-night operation. They have studied the geology in great detail and put their name on the resource estimate for the project. One might also argue that the Australian company has particular expertise on this type of project since high-grade low tonnage epithermal-style deposits are more common in that part of the world.

Dr. Simon Dominy, whom Pretium has asked for an expert opinion, is a respected and published geoscientist who has studied the process of evaluating deposits with erratic and localised occurrences of economic gold grades, reporting mineral resources for high-nugget effect gold vein deposits (1, 2) and resource estimation for many years. His expertise is in exactly the style of deposit we have here.[/box]

Pretivm’s Position

Pretivm maintains that it conceived of the Valley of the Kings bulk sample excavation and associated work as an opportunity to compile and analyze all the possible data which could be generated by a multi-tiered exploration program constrained by the proscribed legislated limit of a 10,000-tonne excavation. Integral to the Program design is the element of corroboration and assimilation for all input data to ensure that any analysis of the deposit will result in robust conclusions about the nature and the extent of the gold mineralization in the Valley of the Kings. It was on this basis that it engaged Strathcona and Snowden, two well-regarded firms, to fulfill their roles as independent experts and act in collaboration on the Program.

“We are disappointed by Strathcona’s decision to withdraw prematurely from the bulk sample program,” said Robert Quartermain, Pretivm’s Chief Executive Officer. “We are satisfied with the results of the initial bulk sample processing, and are confident that the results from the mill will provide the conclusive outcome that our investors expect. The underground drilling and associated development to date has demonstrated that the Valley of the Kings deposit contains significant high-grade gold mineralization.”

Independent Qualified Persons from Snowden are responsible for the review and sign-off of the milling and processing component of the Program, and will issue a final report on its completion.

As previously disclosed, the total amount of gold and silver produced by the mill will be reported on the completion of processing. An updated Mineral Resource estimate for the Valley of the Kings incorporating all 2013 underground and surface drilling and milling results will be prepared following the receipt of all assay data. The updated resource estimate will incorporate learnings from the bulk sample evaluation as well as from additional drilling completed during the underground program so that the confidence and the robustness of the mineral resource estimate can be maximised.

Ivor Jones (FAusIMM(CP)) of Snowden is an independent Qualified Person, as defined by National Instrument 43-101 and is responsible for the resource evaluation at the Project. Ian I. Chang, M.A.Sc., P.Eng., Vice President, Project Development, Pretium Resources Inc. is the Qualified Person responsible for the Bulk Sample Program processing and Feasibility Study. Kenneth C. McNaughton, M.A.Sc., P.Eng., Chief Exploration Officer, Pretium Resources Inc. is the Qualified Person responsible for the Brucejack Project exploration program. The information in this release which relates to the Brucejack Project has been reviewed and approved for release by Messrs Chang, McNaughton and Jones, and they have consented to the inclusion of the information in this press release in the form and context in which it appears.

[box type=”note” align=”aligncenter” ]Like you, we only have access to public data. The impression I get is that Strathcona felt the freedom to perform their job as they saw fit was compromised. Pretium in turn believed that Strathcona was drawing inaccurate and premature conclusions that if published would likely kill their project. It also seems as though there is a bit a personality conflict here.

Regardless, Pretium is facing a lack of trust and concerns over grade that are reflected in their current stock price. This will likely linger for some time regardless of results. In the mining business reputation goes a long way and even a whisper of a problem can shake investor confidence. I for one will be eagerly awaiting the full bulk sample results. You can’t argue with 10,000 tonnes of hard data.[/box]

About Pretivm

Pretivm is creating value through gold at its high-grade gold Brucejack Project, located in northern British Columbia. Processing of the 10,000-tonne Valley of the Kings bulk sample is expected to be completed this quarter. Permitting of a high-grade underground gold mine at Brucejack is underway, with commercial production targeted to commence in 2016.

[toggle title=”We’ve skipped some of the boilerplate. You can read it in here.” state=”close” ]

Forward-Looking Statements

This News Release contains “forward-looking information” and “forward-looking statements” within the meaning of applicable Canadian and United Statessecurities legislation. Forward-looking information may include, but is not limited to, the preliminary mill results from processing the 426585E cross-cut, the estimated gold to be produced from the bulk sample program, the estimated contained gold in the 426585E cross-cut from the sample tower, the estimated tonnage and gold and silver grades of the 426585E Stopes, risks related to our planned exploration and development activities, the adequacy of Pretivm’s financial resources, the estimation of mineral reserves and resources, realization of mineral reserve and resource estimates and timing of development ofPretivm’s Brucejack Project, costs and timing of future exploration, results of future exploration and drilling, production and processing estimates, capital and operating cost estimates, timelines and similar statements relating to the economic viability of the Brucejack Project, timing and receipt of approvals, consents and permits under applicable legislation, Pretivm’s executive compensation approach and practice, and adequacy of financial resources. Wherever possible, words such as “plans”, “expects”, “projects”, “assumes”, “budget”, “strategy”, “scheduled”, “estimates”, “forecasts”, “anticipates”, “believes”, “intends” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative forms of any of these terms and similar expressions, have been used to identify forward-looking statements and information. Statements concerning mineral reserve and resource estimates may also be deemed to constitute forward-looking information to the extent that they involve estimates of the mineralization that will be encountered if the property is developed.

Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance are not statements of historical fact and may be forward-looking information. Forward-looking information is subject to a variety of known and unknown risks, uncertainties and other factors that could cause actual events or results to differ from those expressed or implied by the forward-looking information, including, without limitation, those risks identified in Pretivm’s Annual Information Form dated March 18, 2013 filed on SEDAR at www.sedar.comand in the United States on Form 40-F through EDGAR at the SEC’s website at www.sec.gov. Forward-looking information is based on the expectations and opinions of Pretivm’s management on the date the statements are made. The assumptions used in the preparation of such statements, although considered reasonable at the time of preparation, may prove to be imprecise. We do not assume any obligation to update forward-looking information, whether as a result of new information, future events or otherwise, other than as required by applicable law. For the reasons set forth above, prospective investors should not place undue reliance on forward-looking information.

Neither the TSX nor the NYSE has approved or disapproved of the information contained herein.

[/toggle]

[box type=”success” align=”aligncenter” ]Have a company or release you’d like us to look at? Let us know though our contact page, through Google+, Twitter or Facebook.[/box]