Although Geology for Investors has been online for only about a year, it simultaneously feels like just yesterday – and forever. Believe it or not, we’ve now published almost 300 articles from nearly a dozen different writers. Over the past year the site has matured somewhat and a more developed vision of what the site may become is starting to develop. We have our own ideas of where things might go and have some changes already in motion which we share below, but we’d like to hear your ideas as well. Please let us know what you like or don’t like about this site, how you use it, and how it works or doesn’t work. We want and need your opinion!

A Little Housecleaning

You may have noticed that our publishing schedule has been somewhat reduced lately. Now that the site is getting bigger, we’re finding that content is getting hard to find. This has prompted us to begin re-indexing and reorganizing our content in a way that will be useful and intuitive. As part of the reorganization, we’re:

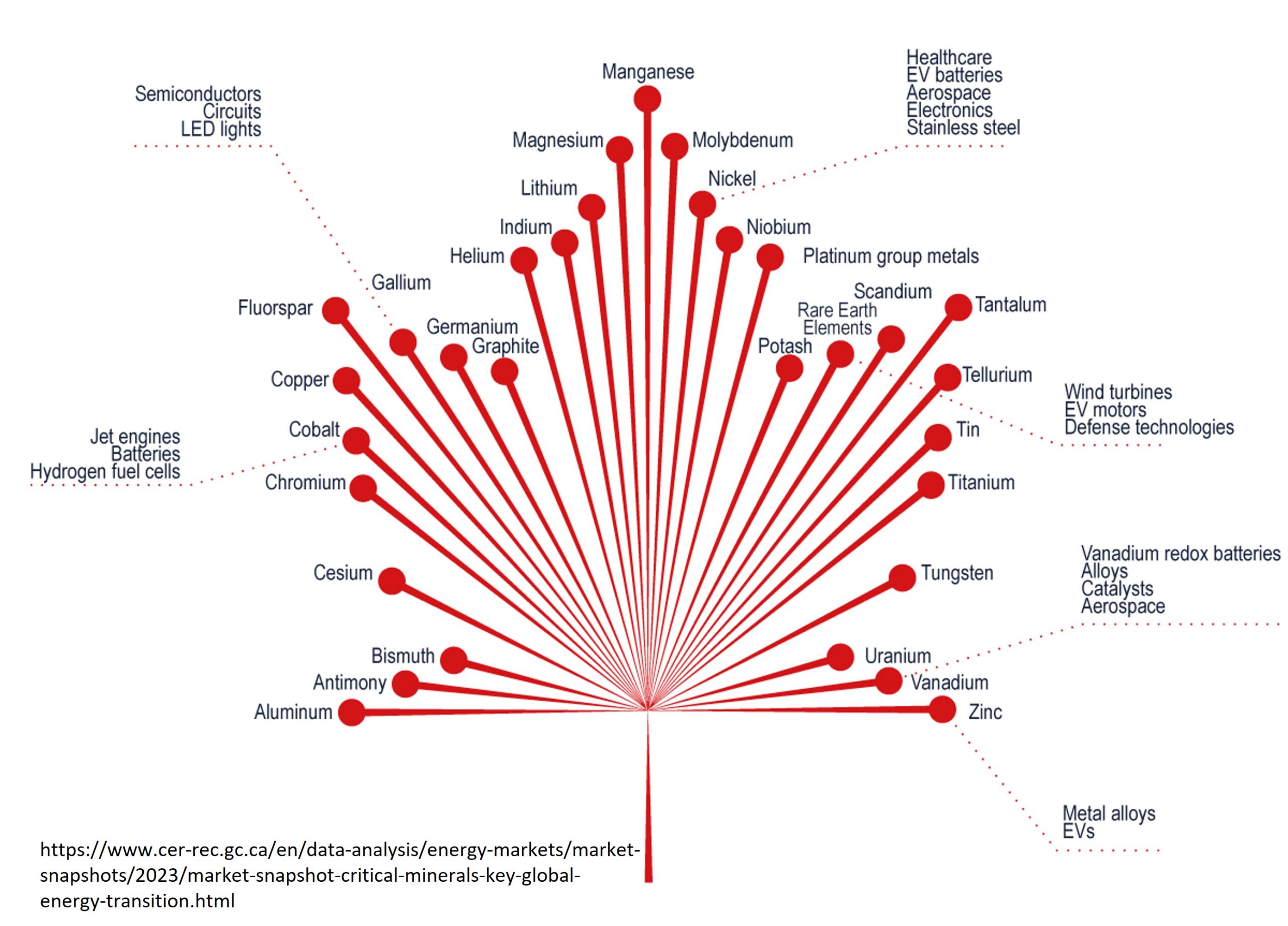

- Expanding our topic tree and introducing more specific subcategories for our content.

- Developing a more intuitive taxonomy that includes geographic and commodity-based tagging of content. This will allow us to ultimately publish an interactive map of the projects and properties we cover and introduce a commodity based menu or search capability that will help you find the content you want.

We’re hoping to have this up and running by the end of next week.

A New Project-based Focus

We started our mining company news release reviews as a sort of instructional guide to looking at company results. The process of reviewing company news has allowed us to develop knowledge base articles to accompany them and address the topics most in need of explanation or education. In that regard they have been largely successful, but one of the legitimate criticisms we receive from these is the lack of continuity in following a project’s “story”. We may cover a company’s news and then not talk about them for six months, or ever. Part of the reason for this is time – it takes a lot of it to research and write these pieces. We can’t review every company and every piece of news, and to be honest we don’t want to.

So instead of writing individual news releases we’re going to start focusing on projects. This will allow us to have a center point for each property we write about – which can then be updated as news develops. This will also integrate well with our map and commodity based search tools.

News will not entirely disappear, but we’re going to stop reviewing each release individually. What we will do instead is begin publishing non-reviewed news which can be connected to the individual project review pages.

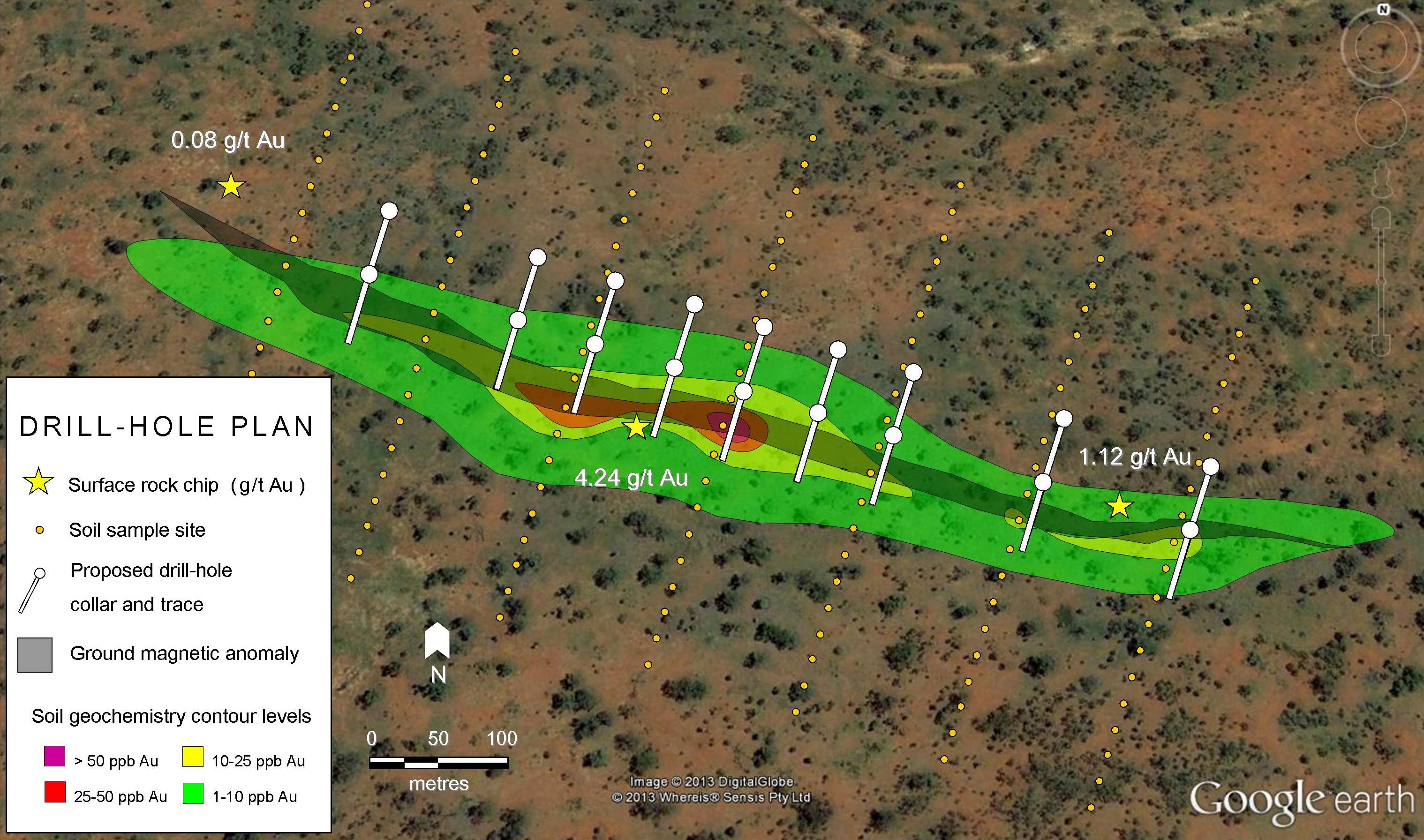

Here’s One for the Little Guy

As part of our project-based focus, we’re going to start publishing articles on “greenfields” prospects and properties not held by public mining companies. There are a few reasons for this. First, while we certainly don’t intend to be a cheerleader for every piece of swampland that comes up for option, there are a lot of good prospects out there worth reading about. Second, a lot of our readers are geologists, prospectors and industry insiders – and we believe that this audience will find the feature most interesting. We also feel that having new prospects alongside more mature or active exploration projects will help round out the site by giving us the opportunity to be more forward-looking in our approach. And heck, nothing beats a good treasure hunting story!

If you have an interesting property you want to write about, please contact us.

Expanding our Geography… and our Knowledge Base

I’ll be the first to admit that it gets a little tiring writing about the many, many gold projects in Canada and Nevada, but often those are the only projects popping up on our radar. We want to make a more concerted effort to write about projects on other continents and would love to hear from you in this regard. Become a contributor and help us expand our reach!

Now It’s Your Turn

We’ve outlined some of the more practical changes taking place, but we’d love to hear your feedback on these changes and other ideas you may have that will help advance the site. Please let us know what you think.

We also welcome discussion on other opportunities to expand and improve Geology for Investors. If you have a proposal for improving the site and would like to get involved (or not) please contact us as well.

Subscribe for Email Updates

You hear again and again from the Rick Rules and Brent Cookes of the world that the people involved in the project are the most important thing. That if you’re going to invest in this highly speculative sector you need to invest with serially successful people developing projects of a nature commensurate to their past experience. Or rather, that should be one important element.

I love the geological interpretations you provide. I also love the knowledge-base available on your site which gives people the tools to make interpretations of their own (or at least do some due-diligence and generate some realistic ball-park expectations). I’d love to see some guidance on how to factor in the “people problem” into those exceptions. Perhaps that is something you could try and implement. In what way I’m not sure.

I’d love to know if there are any red flags or deal-breakers when it comes to people that would make you lose all interest in a potential discovery or deposit. A ceo or president with no shares in the company? A ceo or president who sits on the boards of multiple companies? The way a company chooses to report it’s drill results? A person’s lack of experience in a particular deposit type or the commissioning a geologist who lacks relevant experience? When does drawing a salary become justifiable for an exploration start-up? What sort of compensation is reasonable? A person who doesn’t make themselves available to talk to shareholders or can’t provide a certain level of geological understanding when pressed? In what ways does past success matter, and in what ways is it irrelevant?

These may not be the kinds of questions you are looking to answer through this site, which I understand. As an investor though, these are the questions I often find myself stuck on. I want to know which projects are worth further consideration, but also which people make those projects non-starters.

Thanks for the great site. Either way I appreciate the content you’re putting out.

I would echo smirnoff04’s comments, and also understand that some of those questions might be outside the scope of this website’s mission.

However, it would be great to see what are the “red flags”— and geological case studies of projects gone bad. Maybe a series of articles showing two companies side by side, issuing press releases, one company worked out, the other failed, and see if readers can understand and guess why as the articles progress? You could keep the names of the companies as “Company 1” and “Company 2” from the past, then let readers try to guess which was the right investment. Since the probability of success in early resource investing is low, a great investor must seemingly be most adept at noticing a project gone bad quickly and bailing on it before its too late, in addition to finding the next Hathor. That kind of wisdom would be great. Were there any clues for example regarding Bre-X at all? Probably not since it was outright fraud, but there may be plenty of other projects that bombed. And can one tell by the wording in the press releases, in addition to red flags within the geological data?