Over the “doldrums” of summer I watched the usual news stream of AGM’s, depressing corporate updates, mildly unexciting exploration updates, leavened with the occasional corporate cat-fight, and out and out head scratcher.

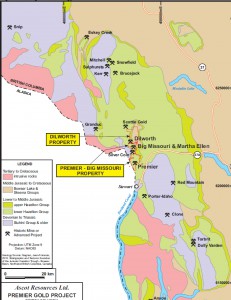

Source Ascot 2014 43-101

Then in late August a news release caught my eye; In a universe where companies pat themselves on the back for achieving 4-5 grams per tonne gold in an exploration program, a drill intercept above 100 g/t gold is immediately eye catching, and a when it’s above 1000 g/t Au, that is some fairly rarefied territory. However there is a region of British Columbia, where those kinds of exploration results are fairly common, and right in the middle of it, is a company called Ascot Resources Ltd (TSX-V:AOT) has been working on a very interesting project called Dilworth-Premier and has achieved the remarkable feat of putting out four news release in row with drilling results greater than 100 g/t gold since the start of August:

- September 14, 2015 Ascot Resources Intersects 257.00 g/t Gold Over 1.00 Meter at Premier

- September 04, 2015 Ascot Resources Intersects 880.0 G/T Gold Over 1.00 Meter At Premier

- August 28, 2015 Ascot Resources Intersects 1009.5 G/T Gold Over 0.90 Meter At Premier

- August 11, 2015 Ascot Resources Intersects 582.00 g/t Gold Over 1.00 Meter at Premier

Though the intervals are narrow, the grades are very high and consistent with an epithermal gold deposit.

Tenure and Location

The Premier-Dilworth Project was optioned by Ascot Resources from Boliden Ltd in 2009 and the initial deal gave Ascot the option to fully purchase the assets of the former Premier mine for a little over $20 Million plus a 1% net smelter royalty (NSR) by the end of 2012. In 2013 this deal was renegotiated and extended to the end of 2015. The new deal called for annual payments of $900,000 per year in 2013 and 2014 plus a lump sum payment of $13,700,000 by December 30th 2015. The lower sale price was offset by an increase in the NSR to 5%. This NSR can be purchased by Ascot for an additional payment of $13,700,000 any time after the end of 2015. The new deal means that if the mine ever reopens Boliden will end up with more cash, but Ascot will need less money to buy the mine. This is probably a reflection of the times: Cash is hard to come by, even for good projects. As with most option deals, if Ascot fails to meet it’s obligations they forfeit all claim to the property and it reverts back to Boliden.

The claims are 20 kilometers north of Stewart, in the coast mountains with the Premier deposit on the side of a mountain. Being a recently operating mine site there are well developed facilities and access to the property is by all weather roads.

Geology

As mentioned before, the project has a very prestigious address, being located in the fabled golden triangle of Northwest British Columbia, north of Stewart, adjacent to the Alaska border where the ore deposits come in two types – massive (Kerr-Sulpherets Mitchell, Snowfields) or rich (Eskay Creek, Brucejack, Granduc). This area was once an area very similar to what the Philippines is today , a loose collection of volcanoes and reefs, cut by multiple faults, and being squished by multiple styles of subduction, which produces the immense heat needed to keep these volcanoes going for millions of years. The long life of these volcanoes is critical to the richness of the mineral systems, as repeated intrusion in the same place (as described in the Grasberg article) is critical to a moving a lot of metal to single location, and secondly to concentrate it by repeatedly sending fertile hydrothermal fluids down the same structure again and again and again, creating these super high grade concentrations.

In the Stewart area, these islands were pushed up against the North American continent, and dismembered by faults then covered by a large thick blanket of sediments known as the Bowser Lake

Group. It is around the margins of this blanket of sediments that these highly mineralized belts poke out, and there is one such window in the Stewart area. The geology of the Stewart area is dominated by Late Triassic-Middle Jurassic island arc rocks, which are volcanic flows, tuffs, lahars (rock derived from volcanic mudflows), volcanic derived sediments, and limestones. These have been intruded by several suites of igneous rocks, of which the most significant is the “Premier Porphyry” which cross cuts earlier rocks and is associated with the epithermal vein system.

The project is a high grade low sulphidation epithermal system, which is middle Jurassic in age (185 Million years ago). Low sulphidation refers to the style of alteration and mineralization and it is characterized by quartz, and galena (lead sulphide), sphalerite (zinc sulphide) and chalcopyrite sulphide (iron-copper) mineralization. Alteration moves from high temperature potassium-sericite replacement to distal, cooler, epidote, chlorite, clay.

Precious metal mineralization is hosted in the silica core of the vein in sulphides, with gross sulfide mineral content ranging from 5% to 75%. In higher grade zones associated with silicieous breccias there is native gold and electrum (a natural gold silver allow) present. Sometimes these higher grade zones can be extremely rich with a 2014 drill intercept reporting 14,394.5 g/t (>460 ounces) gold over 0.75 of a meter.

History and Current work

The initial deposit was discovered in 1917 when a group of lucky prospectors drifted off a tunnel and hit the deposit a few feet from the previous owners test shaft. Development followed and from 1918 to 1996, the deposit produced 2 million ounces of gold, with 42 Million ounces of Silver and substantial base metal credits. It was optioned by Ascot in 2009 and they have proceeded to explore it apace. The current exploration plan is to target the higher grade portions of the deposit to see if there is potential for a small based on the targeting of the high grade zones. Current geological models by Ascot suggest that the vein flattens at depth and that there remains substantial untested strike length.

Subscribe for Email Updates