With a shallow gold resource already defined and a several interesting prospects in a vastly under explored jurisdiction, this junior miner has a lot of work to do. Their first job will be to determine if these grades can be repeated with further drilling along trend.

[box type=”info” align=”aligncenter” ]Disclaimer: This is an editorial review of a public mining company press release and is not an endorsement. It may include opinions or points of view that may not be shared by the companies mentioned in the release. The editorial comments are highlighted so as to be easily separated from the release text and portions of the release not affecting this review may be deleted. Read more at How to Use this Site.[/box]

VANCOUVER, BRITISH COLUMBIA–(May 12, 2014) – Orca Gold Inc. (TSX VENTURE:ORG) (“Orca” or the “Company”) is pleased to announce a new discovery at its Block 14 mineral licence in Sudan.

Recent first pass RC drilling (4 holes totaling 481m) at the EG3.2 prospect in Block 14 (see map appended) has returned significant widths of lower grade mineralisation surrounding substantial high grade intercepts:

[box type=”note” align=”aligncenter” ]

In September 2013, we reported Orca Gold’s (TSX: ORG) past work on their Galat Sufar South prospect (GSS) in northwestern Sudan. Since then the company has filed a NI 43-101 detailing both indicated and inferred mineral resources for the GSS prospect as well provided some insight on the EG3.2 prospect located in Block 14. A NI 43-101 from Galat Sufar South, coupled with this recent drilling could shape Block 14 into an interesting gold play.

This release deals with their results from a recent RC drilling program on the property.

[/box]

| Hole | From | To | Metres | Au g/t Uncut | Au g/t Cut to 10g/t | Au g/t Cut to 20g/t |

| GSRC339 | 9 | 23 | 14 | 65.79 | 7.04 | 10.99 |

| 28 | 34 | 6 | 1.22 | |||

| 55 | 63 | 8 | 1.61 | |||

| 70 | 79 | 9 | 6.76 | 3.71 | 5.93 | |

| 82 | 86 | 4 | 1.37 | |||

| GSRC340 | 42 | 46 | 4 | 0.62 | ||

| 68 | 73 | 5 | 1.97 | |||

| 77 | 94 | 17 | 1.56 | |||

| 97 | 126 | 29 | 1.26 | 1.23 | 1.26 | |

| 134 | 138 | 4 | 0.55 | |||

| GSRC341 | 29 | 50 | 21 | 19.35 | 4.94 | 6.77 |

| 56 | 59 | 3 | 3.31 | |||

| 92 | 96 | 4 | 1.34 | |||

| GSRC342 | 6 | 13 | 7 | 7.07 | 3.13 | 4.56 |

| 19 | 25 | 6 | 1.03 | |||

| 30 | 61 | 31 | 1.25 | |||

| 71 | 80 | 9 | 2.03 | 2.02 | 2.03 | |

| Note: Holes are drilled at -55° and as such true widths are interpreted as being 57 to 75% of intercept length. | ||||||

[box type=”note” align=”aligncenter” ]

RC drilling is a fast and cheap method of getting samples from relatively shallow deposits, but it does have its limitations. Since it produces rock chips and not drill core , the interval thickness can be somewhat obscured. This can be a problem in narrow vein settings where a high level of accuracy is necessary for the planning of future drill targets. In addition, the absence of drill core can make it more difficult for the geologist to understand the subsurface geology. Still, RC drilling can be a good reconnaissance tool and is useful in early exploration or where the geology is well understood.

There a few items worth noting in these results.

First, the company is reporting results that are uncut, cut to 10g/t and cut to 20 g/t. What does this mean? Lab assays are normally capped in order to reduce the possibility of statistical outliers skewing the results. In an assay with these types of outliers the result is normally referred to as the “nugget effect” and literally means that a small grain or nugget affected the results. These “nuggets” can cause the average grade for an interval to report much higher than it would be without the “rogue nugget”. The cap is normally determined in association with the lab and is based on typical expected results for a deposit type. For example, if a series of samples normally assays at less than 10 g/t – which is the case here – a sample with 65.79 g/t would be capped at 10 g/t in the lab report. The resulting value of 7.04 is the average of the interval when the smaller high grade outlier is capped at 10 g/t. The same goes for the samples capped at 20 g/t.

The capping of grades can be a problem when a deposit has narrow high grade veins or a very high, but consistent, nugget effect. In these cases, capping underreports the actual grade. A good example of this is Pretium’s Brucejack deposit where an “extreme nugget effect” led to some controversy over bulk sampling this past fall.

Lastly, note that the drilled intervals do not represent true thicknesses. The company will need to do a lot more drilling before the true thickness of the mineralized unit can be defined

[/box]

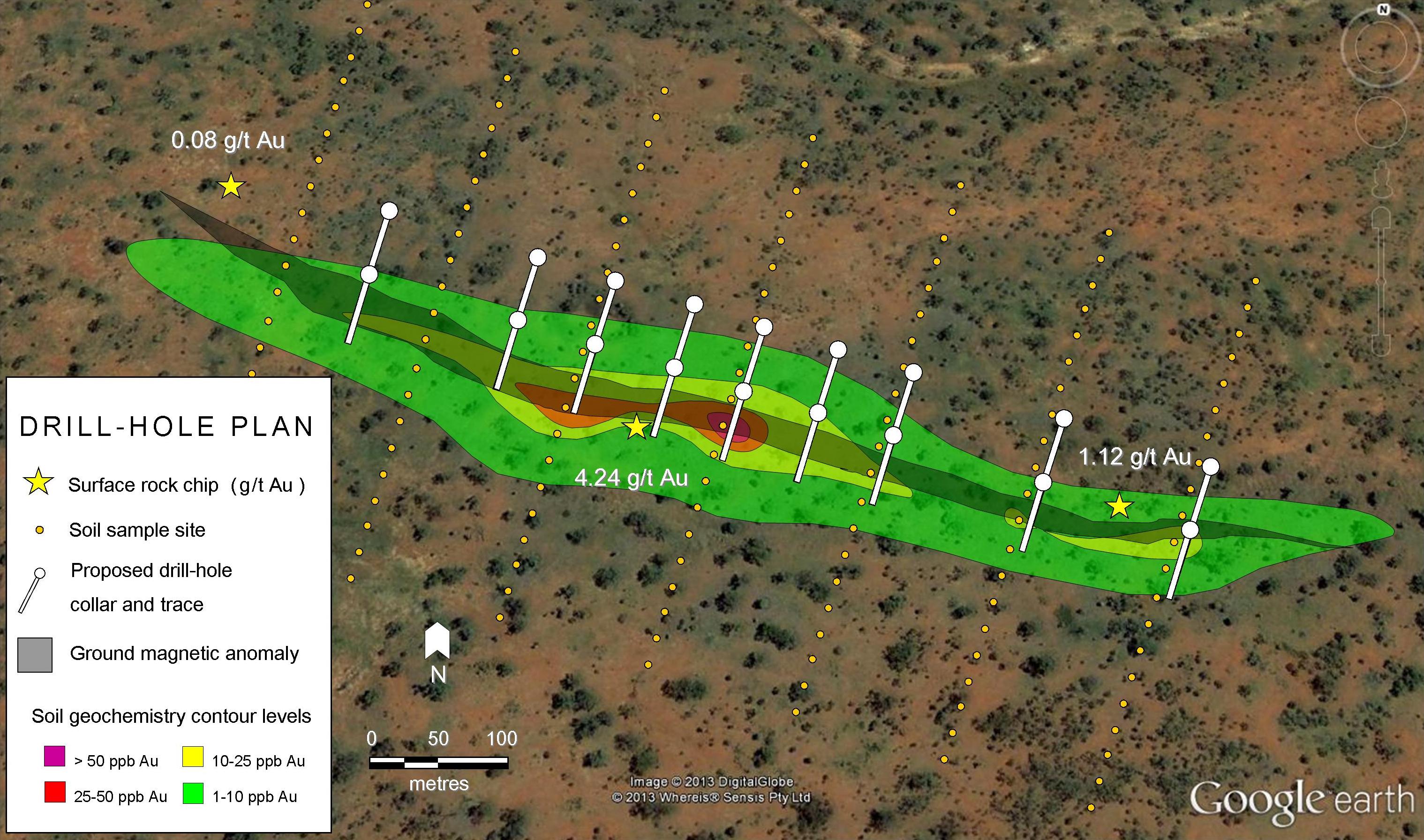

This first pass drill program was designed to test one of 3 areas of artisanal activity at EG3.2 where chip channel sampling previously returned 13m at 3.15g/t and 20m grading 1.24g/t within an area of workings of 150m by 65m.

Mineralisation is hosted by intensely sericite and silica altered diorite containing up to 5% disseminated sulphides in the form of pyrite. The mineralisation strikes north-north-east and is notable for the lack of quartz veining.

[box type=”note” align=”aligncenter” ]

What’s interesting about this prospect compared to the company’s GSS prospect to the west is that mineralization is not restricted to Quartz veins. Gold in this case is found associated with fine grained pyrite (iron sulfide) sprinkled throughout the strongly altered igneous host rock.

[/box]

Chip channel sampling of the other two areas of workings, which are interpreted as being on parallel structures 100-150m to the east, returned 30m at 1.38g/t, 25m at 0.48g/t and 25m grading 2.62g/t.

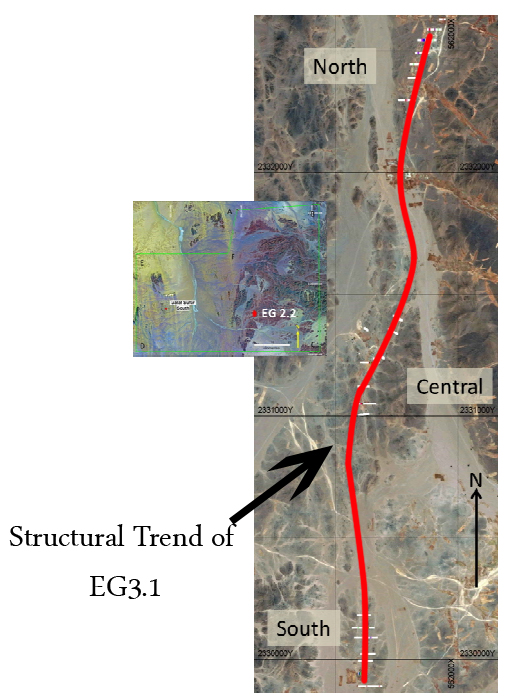

The discovery at EG3.2 is significant as it is the first time at Block 14 that the Company has encountered high grade intercepts in the eastern part of the 7,046km2 Block 14 license. Numerous other targets have been generated using geochemistry and generative exploration and remain to be drilled.

[box type=”note” align=”aligncenter” ]

Exploration at a bird’s eye view can often be more useful than closely examining a rock. Case in point: The satellite image below shows past “artisan mines” and more recent channel samples associated with those mines. These location outline the overall trend or structure of the EG3.2 prospect. The trail of workings left behind by artisanal miners has created a literal exploration map for the company.

[/box]

Exploration to date by Orca has focused on the Galat Sufar South (“GSS”) area, 60km to the west of EG3.2. Orca announced an initial Mineral Resource at GSS on January 29, 2014 comprising an Indicated Resource of 22.2MT at 1.84g/t for 1.3 million ounces gold and an Inferred Resource of 6.5Mt at 1.9g/t for an additional 400,000 ounces gold. Greater than 90% of the Mineral Resource is within 100 metres of surface.

[box type=”note” align=”aligncenter” ]

Orca Gold’s stock bounced to life from $0.47 to $0.54 when this news hit the market a few days ago: A sign that perhaps investors were eager for some news. With a shallow gold resource already defined and a several interesting prospects in a vastly under explored jurisdiction, this junior miner has a lot of work to do. Their first job will be to determine if these grades can be repeated with further drilling along trend.

[/box]

Simon Jackson, President and CEO, said, “We are excited by the high grade intercepts at EG3.2. This drill program was our first in the Eastern portion of the license and these initial results support our belief that Block 14 will host multiple gold deposits. We will continue to expand our exploration at EG3.2 to target the parallel zones to the east. Exploration is ongoing in other areas of Block 14 and we will keep the market informed as we move forward.”

About Orca

Orca Gold Inc. is a Canadian resource company focussed on exploration opportunities in Africa. The Company has an experienced board of directors and management team and a strong balance sheet that includes a substantial treasury.

The technical contents of this release have been approved by Hugh Stuart, BSc, MSc, a Qualified Person pursuant to NI-43101. Mr. Stuart is the Vice President Exploration of the Company and a Chartered Geologist and Fellow of the Geological Society of London.

Samples used for the results described herein are prepared and analyzed by fire assay using a 50 gram charge at the ALS Chemex facility at Rosia Montana in Romania in compliance with industry standards. Field duplicate samples are taken and blanks and standards are added to every batch submitted.

[box type=”success” align=”aligncenter” ]Have a company or release you’d like us to look at? Let us know through our contact page, through Google+, Twitter or Facebook.[/box]