You don’t have to look very hard to find someone predicting a resource shortage, whether its’ peak oil or more recent concerns of a lithium shortage. The newest element of concern is copper, with predictions of severe supply shortfalls ahead. So what does the future really hold for the red metal?

Copper: A Critical Metal

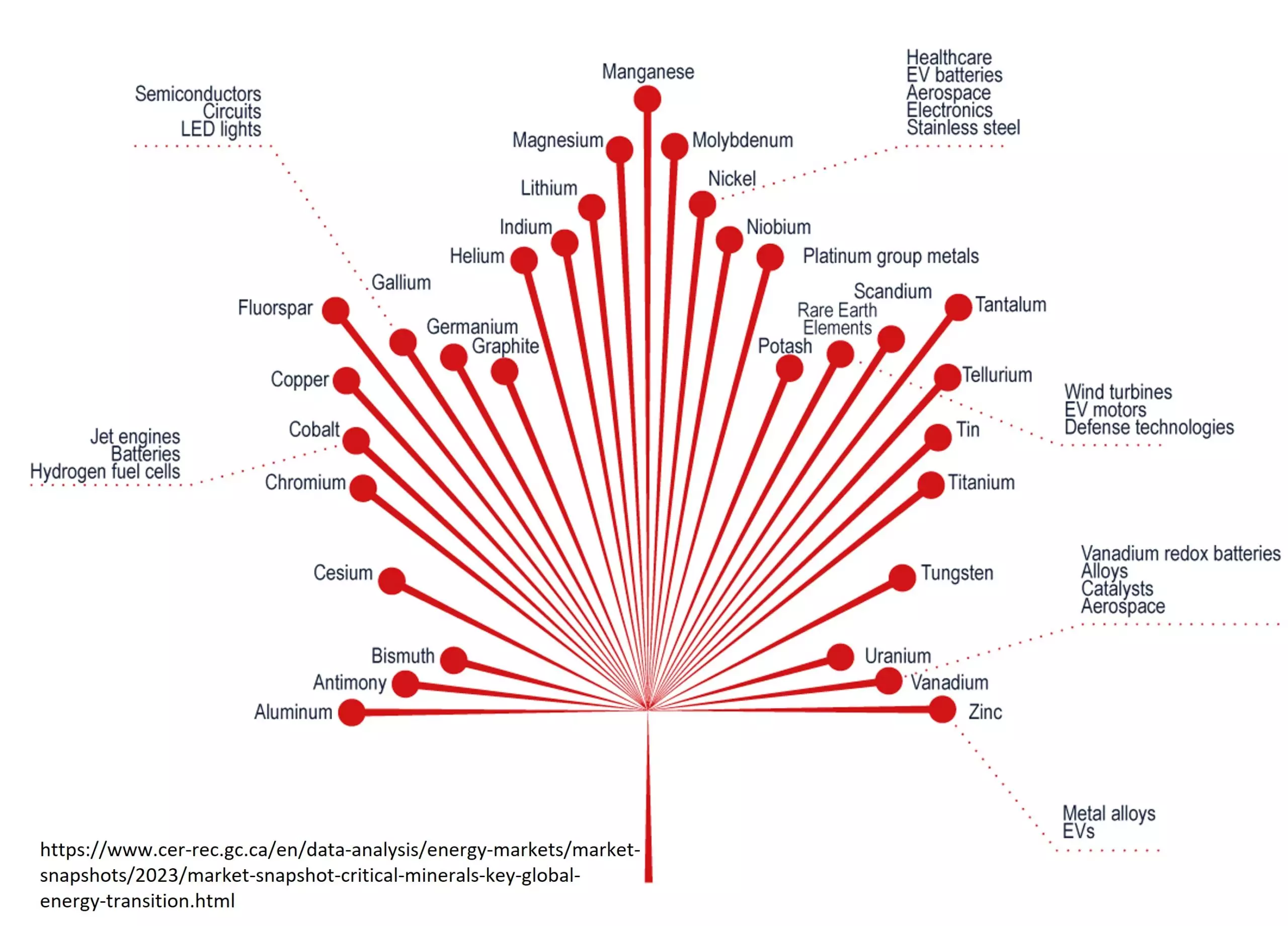

Copper (Cu) is a soft, ductile red metal with a very high electrical and thermal conductivity. These properties, combined with a resistance to corrosion, has made copper essential to almost all electrical devices. As a rule, if it uses electricity, it depends on copper.

The push for electrification and green technology is heavily dependent on copper, with an average EV consuming 2-4 times as much copper as a conventional vehicle, with charging stations requiring even more. Renewable electricity requires >5 times more copper than conventional electricity, with offshore wind being particularly copper-intensive. Copper demand is forecast to increase by 16% by 2030, and 30-60% by 2040.

Copper was probably the first metal ever exploited by humans and has found many uses over the years. Today its main uses are wiring (60%), roofing and plumbing (20%), and machinery (15%). Copper’s strong link to construction, especially of electrical and industrial infrastructure, makes copper prices an indicator of overall economic health and development.

Copper is not an obvious metal to be running out of. Copper isn’t particularly rare, being almost 5 times more common than lead, and it occurs in many different deposit types. In fact copper is so ubiquitous that the ore grade of polymetallic deposits is often expressed as copper equivalency. Copper has been mined for thousands of years, and the how, why, and where of copper exploration and mining is well understood.

Despite this, copper production has been under stress for many years. While copper production has increased, ore grades have fallen; today most large copper mines are below 0.5% Cu, in some cases 0.25% or below.

The Geology of Copper

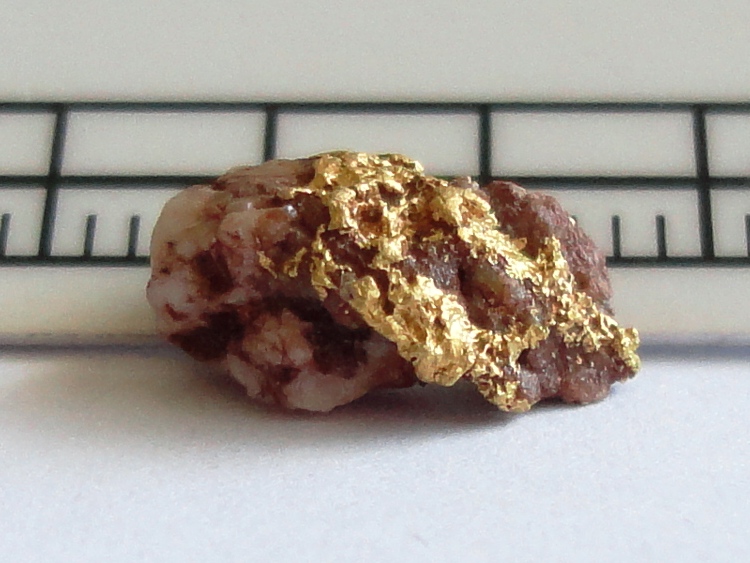

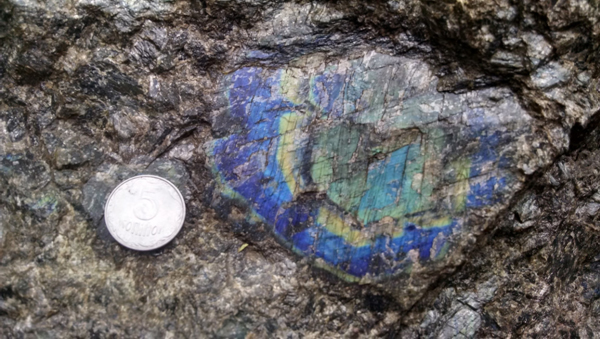

Copper forms many different minerals, but most copper ores are sulfides, with chalcopyrite (CuFeS2) being the most common. Copper is found in many types of deposits such as Volcanogenic Massive Sulfide (VMS), magmatic sulfide, Iron-Oxide-Copper-Gold (IOCG), Sediment-hosted Stratiform Copper (SSC), and Cu porphyries.

Copper Porphyry deposits dominate copper production, accounting for approximately 60% globally. These form from fluids released by certain porphyries, igneous intrusions that crystalize at a relatively shallow depth. Since magma can contain more water than solid rock, these bodies release hot, saline water as they crystallize. This water is perfect for transporting copper, allowing it to concentrate the red metal as it circulates through the surrounding rocks. Eventually this water cools, precipitating copper, as well as other metals such as molybdenum and gold, in a stockwork of quartz veins around the upper part of the intrusion. Where fluids reach high enough pressures they may shatter the host rock, forming breccia pipes.

Since porphyry magma doesn’t contain very high concentrations of Cu, forming a large porphyry deposit requires a large volume of magma. It’s thought that the largest Cu porphyries form in many stages which may span as much as two million years. This must occur without the magma reaching the surface, which would trigger a major eruption and destroy the deposit.

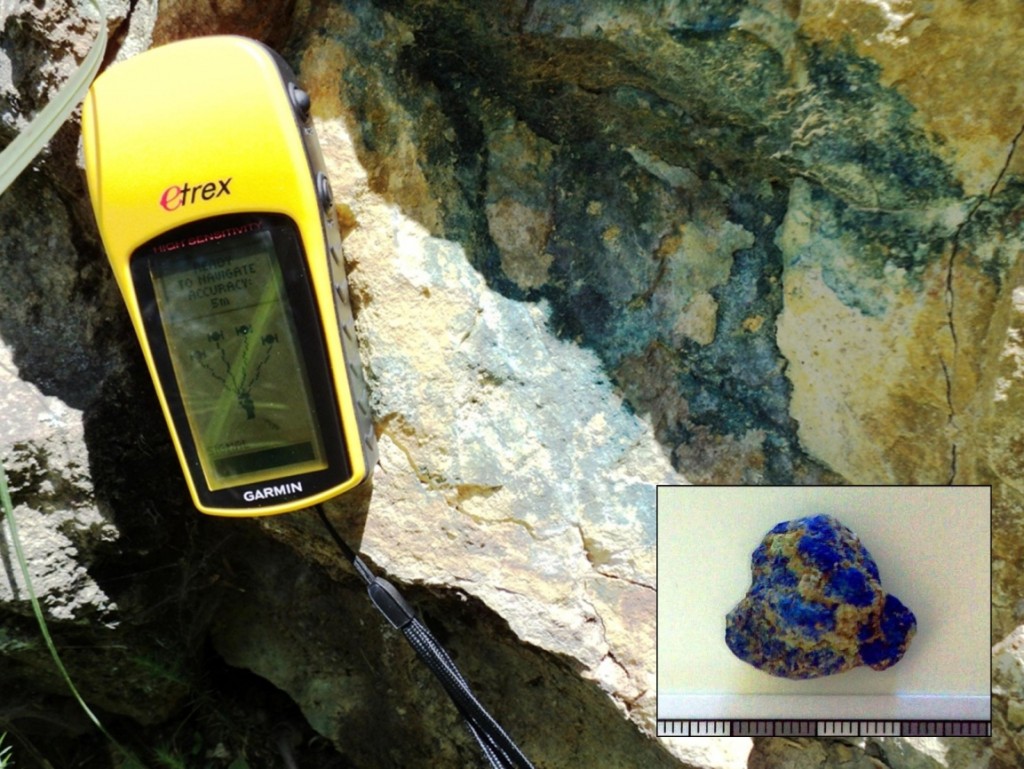

Copper Porphyry deposits characteristically have a zonation, with multiple nested shells of alteration due to decreasing temperature away from the intrusion. Potassic alteration tends to dominate the core areas, with alteration styles grading outwards into Propyllitic-Argillic-Phyllic, although not always in that order. This alteration often covers a very large area, which, combined with geophysical methods such as electromagnetic response, provides a basis for locating porphyry deposits.

Copper Porphyries are generally low grade (<1% Cu) but may have very large tonnage (~100-1000s Mt). They are mined mainly from open pits, which may be among the largest in the world, although mines may switch to underground methods once shallower ores are depleted. Many of the largest Cu porphyries have been or will be mined for over 100 years. Porphyries also produce nearly all of the world’s molybdenum, as well as the rare elements rhenium, selenium, and tellurium, and are significant producers of gold and silver.

The distribution of copper porphyries is strongly controlled by tectonic processes. As oceanic crust gets subducted back into the Earth increases in heat and pressure force out the water it has absorbed during its time on the seabed; this water rises into the overlying hot rocks, lowering their melting point and triggering formation of the magmas which will become porphyries. Water often acts as a sort of geological lubricant, enabling or speeding up many processes, especially ore-forming ones.

Since Cu porphyries form at shallow depths (~1-6 km) they are prone to being eroded away over geologic time. Most known Cu porphyries formed within the last 20 million years, and their distribution reflects the locations of modern subduction zones, especially the Pacific ring of fire. While a few large Cu porphyry deposits are found in the south Pacific, the lion’s share is found in belts parallel to subduction down the west coast of north and South America.

Subduction beneath continents, such as occurs off the west coast of South America, is associated mainly with Cu porphyries, while subduction beneath oceanic crust, such as occurs in Indonesia and Papua New Guinea, is associated with more gold-rich porphyries.

Cause for Concern?

It is estimated that only 12% of the world’s copper has been mined. Chile, by far the world’s largest producer with 27% of global output, as reserves to last at least another century at current rates. Copper also boasts the highest recycling rate of any base metal. The problem isn’t running out of copper, it’s producing it fast enough.

It has been clear for some time that copper supply is unlikely to keep pace with rising demand over the long term. Green infrastructure is consuming ever-larger amounts of copper, but supply is expected to stagnate. The court-ordered closure of First Quantum’s Cobre Mine in Panama wiped out predictions of a near-term supply glut. While a few new projects, such as Ivanhoe Mine’s Kamoa-Kakula, have come online in recent years, there’s not much in the pipeline behind them.

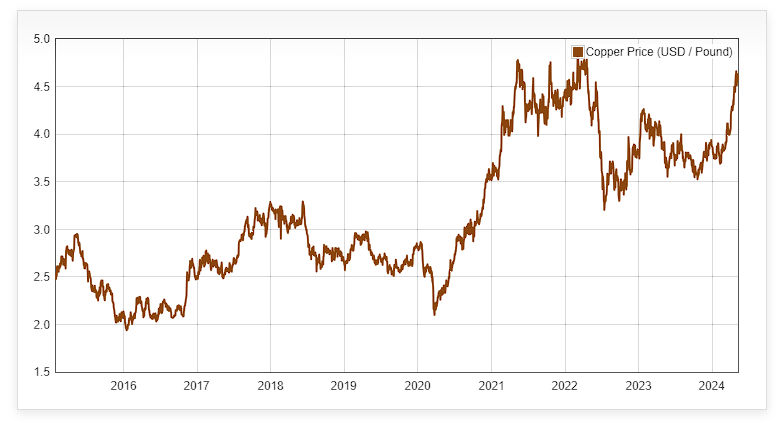

What projects are on the horizon are many years out, while others, such as Northern Dynasty’s Pebble Mine, have been stalled due to environmental concerns. Supply deficits are forecast to begin in late 2024-2025 and continue out to 2030. Some analysts predict prices to rise as much as 75% over the next 2 years.

Expanding production from existing mines is unlikely to be a solution in the short term. Most large copper mines are low-grade, high-tonnage operations, and expanding production will require major upgrades to cope with the ever-larger tonnage required.

Geopolitics has also come into play; instability in Peru, the 2nd largest copper producer, has reduced investment and contributed to stagnating output and a lack of new mines in the country, which is believed to have significant untapped potential. The DRC, which has emerged as the third-largest producer in recent years, also has a history of political instability. Sanctions may affect production in Russia, which is the 7th largest producer but has the fourth largest reserves.

Cutting back on copper demand will be difficult. The only metals which can readily replace copper in electrical applications are silver, which is far too rare and expensive, and aluminum. Aluminum has a lower melting point and electrical conductivity than copper, meaning aluminum wiring must be significantly thicker than copper wiring to carry the same amount of current without melting.

While increases in copper prices have been flagged as an obstacle to the green transition and potential fuel for inflation, so far they haven’t led to the correspondingly large investments required to compensate for rising demand. With new mines taking 10+ years to reach production, a long-term copper shortage seems all but inevitable.

Investor Takeaways

While we’re not close to running out of copper, rapidly increasing demand driven by green infrastructure is not being matched by copper production, which is expected to remain largely stagnant for the foreseeable future. Many years of investment in exploration and development will be required to correct this, and the price of copper is likely to rise steeply over the next few years.

List of Companies Mentioned

- First Quantum https://first-quantum.com/ (website)

- Northern Dynasty https://northerndynastyminerals.com/about-us/pebble-partnership/ (website)

- Ivanhoe Mines https://www.ivanhoemines.com/ (website)

Further Reading

- Chiaradia, M., Caricchi, L. Supergiant porphyry copper deposits are failed large eruptions. Commun Earth Environ 3, 107 (2022). https://doi.org/10.1038/s43247-022-00440-7

Subscribe for Email Updates