In the annals of geology there are standard deposits which occur worldwide. Their genesis is well understood and their tonnage and grade predictable. Then there are these wild freaks of nature that boggle the mind in how and what created them. The Witwatersrand (Wits) paleo placer Gold-Uranium deposits which have produced 1.6 Billion ounces of gold, are one such so large, so utterly singular, and so freaky as to be thought to be a chance occurrence and unique worldwide.

When Novo Resources (CSE:NVO) discovered Gold in setting analogous to the famous Witwatersrand deposits in Western Australian there was a fair bit of excitement. Novo had proposed that their Beaton’s Creek paleoplacer could be an extension of the Wits basin, the two pieces long seperated by continental drift.

Genesis

The story starts 2900 million years ago. After a 1700 million years of the Earth slowly cooling, and the slow evolution of life the earth’s atmosphere was starting to change with profound implications.

One of these was the change in chemistry from a relatively gold saturated ocean to a relatively gold undersaturated ocean that occurred with the formation of the first continents. Another was a burst of volcanism and assembly of continents. This created a window of opportunity for large, gold rich sedimentary basins like the Wits to form. The genesis of the wits deposits have been debated for over a century, with some interpreting them as placers formed from heavy minerals deposited by ancient rivers, while others see them formed by hydrothermal fluids replacing minerals within layers of river gravel.

There must have been many, many such basins but most have eroded away. By chance what became Western Australia and South Africa were beside each other (VaalBara – from the South Africa KaapVaal and Australian Pilbara) during the critical time period as the Wits was forming. They would soon break apart and never be together again.

Putting the Pieces together

It took a prospector’s hunch to stake the ground, and geologists intuition to explore it. The rocks around Beatons Creek had been explored in the 1960’s but their affinity had not been pinpointed as uranium was the primary exploration target at the time. Since then a small resource (under 500K ounces Gold) had been built up by various companies but no definitive connection had been made between the wits, and the gold was thought be thin and discontinuous.

Mark Creasy recognized the gold-bearing conglomerates (a sedimentary rock consisting of large pebbles cemented together) and historic workings and acquired the ground.

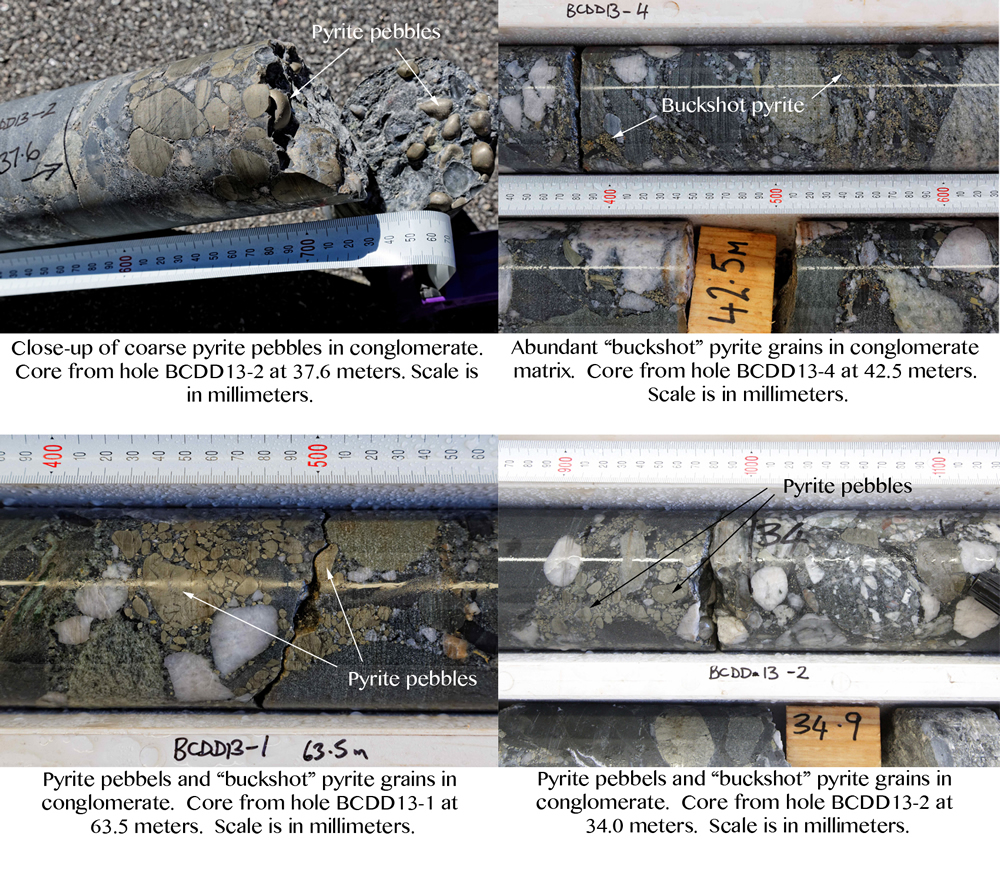

In 2010, Geologist Dr. Quentin Hennigh, President of Novo Resources, recognizing the significance and acquired the ground. Exploration confirmed the “smoking gun” – a quartz-pyrite-gold-uranium conglomerate. These conglomerates only formed before 2.2 Billion years ago when there was too little oxygen to destroy the pyrite and uranium minerals. They occur in only a few areas of the globe including the Wits. Armed with this knowledge the company did step out drilling from the known areas and the results were gratifying – 35 meters at 2.08 grams per tonne (gpt) gold including 3 meters at 14.26 gpt gold in hole BCRC11-002, 27.45 meters at 1.54 gpt gold including 2.30 meters at 12.41 gpt gold in hole BCDD13-008. Numerous gold prospects were identified in a ~50 km radius.

The Pieces Come Together…And Fall Apart

A 2019 preliminary resource estimate placed indicated resources for Beaton’s Creek at 457,000 Oz of gold at 2.1 g/t and 294,000 Oz at 2.7 g/t gold. Novo commenced open pit mining shortly thereafter, but production didn’t last long. A new resource estimate in 2022 led to an immediate suspension of mining as resources plummeted to 234,000 Oz of indicated gold at 2.4 g/t, plus 42,000 Oz of inferred gold at 1.6 g/t. Novo cited resource depletion and disappointing results from infill drilling. Novo also suspended work on a feasibility study.

At the time Novo announced it it intended to resume mining once permits for a new area came through. Today Novo’s website makes little mention of Beaton’s Creek, and it’s not clear when or if mining will resume; instead they appear to be focusing on exploration on their other gold projects in the region. Novo’s stock has dropped by over 95% since 2020.

Novo appears to have made a classic mining mistake: going into production without a full understanding of the ore body. In this case Novo started mining with only a preliminary economic assessment and only lower confidence indicated resources. It’s not hard to see why Novo was tempted: an open pit in a mining-friendly jurisdiction like Australia with 750 000 Oz of gold at over 2g/t seems like a clear money-maker. The most likely reason there turned out to be so much less gold than first thought is that the gold is mostly confined to rather narrow ancient river channels. One of the things that makes the Witwatersrand deposits so special is how continuous the ore is over large areas; Beatons Creek seems to lack this important attribute.

The Wits itself may be reaching the end of its’ mining days too. Only a few mines are still producing, and they’ve been forced to delve so deeply that it may not be possible to continue much longer.

There’s still a lot of prospective ground out there, but the potential for another wits has yet to be realized. Rocks old enough to host these rich quartz-pebble conglomerates are relatively rare, and most have been heated, crushed, deformed, and metamorphosed, potentially destroying, or at least concealing, any deposits.

The next great discovery is out there, but for now it remains elusive.

Further Reading

- Horsecroft FDM, Mossman DJ, Reimer TO, Hennigh Q, 2011 WITWATERSRAND METALLOGENESIS: THE CASE FOR (MODIFIED)SYNGENESIS in Microbial Mats in Siliciclastic Depositional Systems Through Time, SEPM (Society for Sedimentary Geology), ISBN 978-1-56576-314-2, p. 75–97

List of Companies Mentioned

- Novo Resources (website)