Overview

The Red Chris deposit is a copper-gold porphyry deposit in northern British Columbia, Canada. As of 2019 Red Chris is 70% owned by Newcrest Mining Limited and 30% owned by the Red Chris Development Company Ltd. which is wholly owned by Imperial Metals Corporation (TSX:III). Newcrest was acquired by Newmont in 2021. Royal Gold acquired a 1% net-smelter royalty from Red Chris production for $165 million in 2021. The mine opened in 2015, and produces from an open pit, with underground development planned as well.

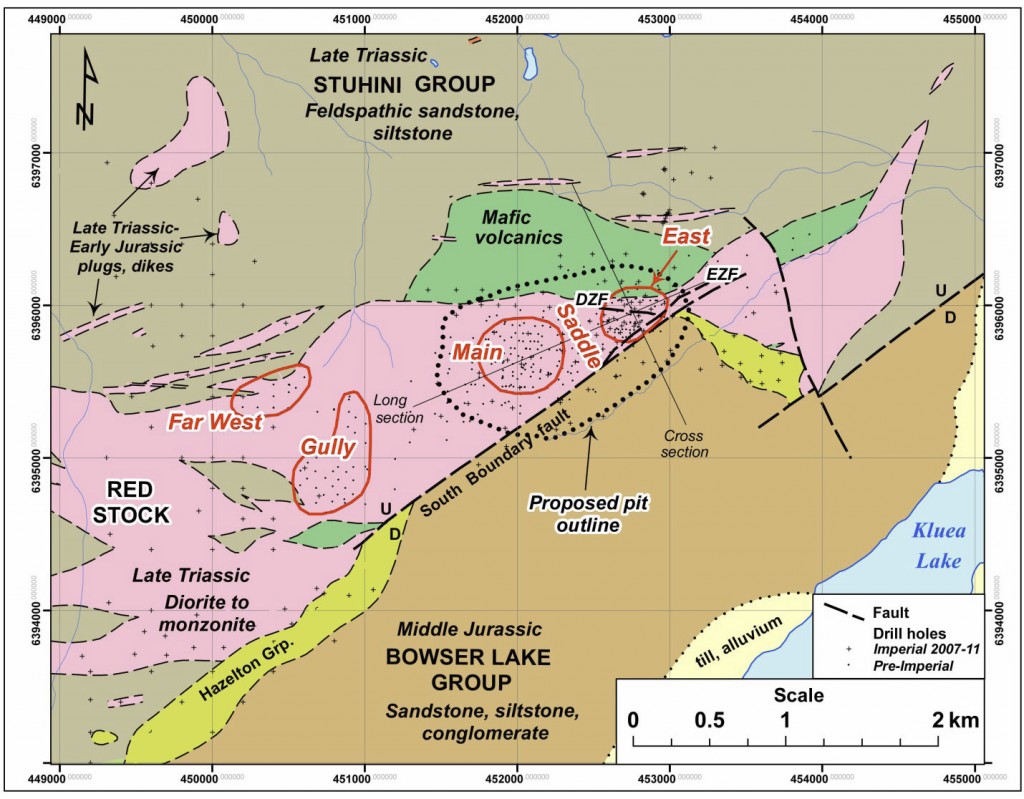

Regional Geology

The Red Chris deposit is located in the “Stikinia” terrane, a ancient volcanic arc dating to early Mesozoic times and later accreted to older basement rock in the region. The entire area was subjected to the folding and thrusting of the late Cretaceous Laramide Orogeny, a period of mountain building that resulted in the Rocky Mountains of North America. A large number of gold, silver and copper projects are located in the same regional geologic terrane, forming British Columbia’s Golden Triangle.

Copper-porphyry deposits are known to be concentrated along the Circum-Pacific Ring of Fire, and several are located in BC.

Deposit Geology

The Red Chris deposit is hosted in the Late Triassic (201-235 million years ago) “Red Stock”, an elongate intrusive rock complex. It is considered a porphyry deposit, formed from hot, metal-rich fluids released by crystalizing magma.

Mineralization occurs as disseminated, or dispersed chalcopyrite (CuFeS2) and bornite (Cu5FeS4) in quartz veins and microfractures hosted in “granitic” rock.

In 2015 the deposit was estimated to host more than 300 million tonnes at 0.359% copper, 0.274 g/t gold and minor silver which roughly equates to a CuEq of 0.53%. As of 2020 measured and indicated resources stand at 980 Mt at 0.38% copper and 0.41 g/t gold, with inferred resources of 190 Mt at 0.30% copper and 0.31 g/t gold.

Discussion

A good deal of infrastructure is required for mining projects aside from the mine itself. The Red Chris mine required the construction of new roads and power transmission lines in addition to camps and facilities for staff. For mines located in remote locations, this can be financially taxing and the deposit must be especially rich in order to justify development.

In 2020 Red Chris produced 88.3 M lbs and 73 787 oz of gold, worth ~$555 million at current prices.

Exploration at Red Chris has been highly successful in expanding resources, and plans are currently underway to transition into an underground operation as the remaining ore becomes deeper. The fact the Royal Gold was willing to spend so much money on acquiring a 1% royalty speaks to a great deal of confidence in the future of Red Chris for decades to come.

In 2015, several companies were exploring copper-gold porphyry targets nearby the Red Chris property including Colorado Resources and Revolver Resources. Colorado Resources was acquired by Skeena Resources in 2022; Revolver Resources is now focused on copper exploration in Australia.

Further Reading

- Imperial Metals

- Newmont: https://operations.newmont.com/north-america/red-chris-canada

- Royal Gold: https://royalgold.com

- Stikine Terrane Cu, Cu-Au & Mo Porphyry Deposits BC Geological Survey

- Skeena Resources: https://skeenaresources.com/investors/acquisition-of-questex-gold-copper-ltd/

Subscribe for Email Updates