Some exploration companies would get excited with just the gold results alone, especially if the vein was much closer to the surface.

[box type=”info” align=”aligncenter” ]Disclaimer: This is an editorial review of a public press release and may include opinions or points of view that may not be shared by the owners of geologyforinvestors.com or the companies mentioned in the release. The editorial comments are highlighted so as to be easily separated from the release text. Please view the full release here.[/box]

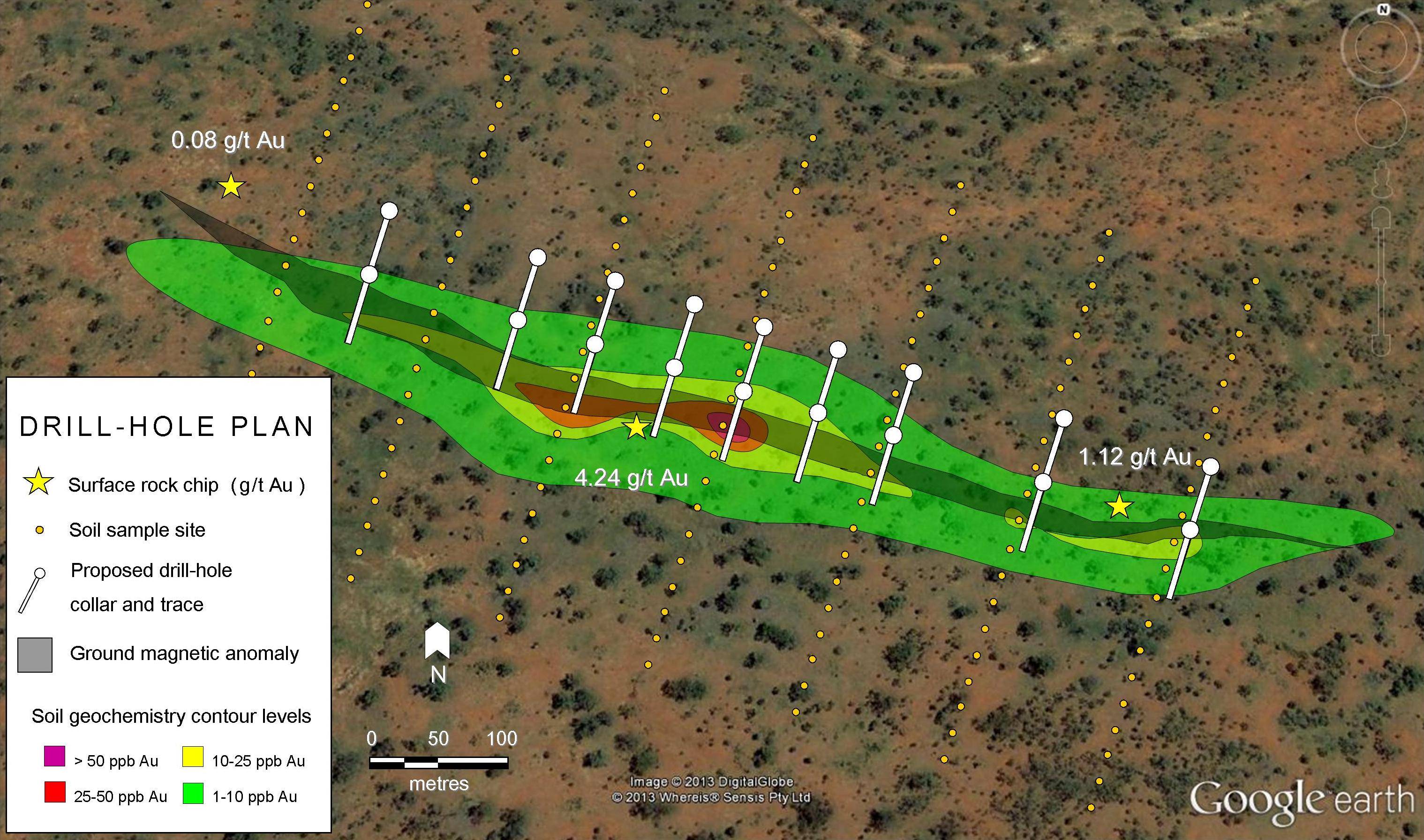

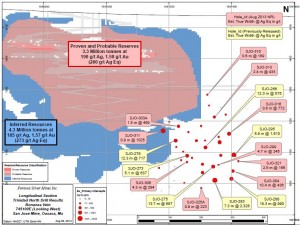

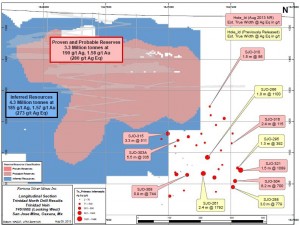

VANCOUVER, Aug. 15, 2013 /PRNewswire/ – Fortuna Silver Mines Inc. (NYSE: FSM | TSX: FVI | BVL: FVI | Frankfurt: F4S.F) is pleased to report results for twelve additional surface drill holes at the Trinidad North high-grade silver-gold discovery at the San Jose Mine in Mexico. With the exception of drill hole SJO-304, the reported drill holes are generally positioned to define the approximate limits of the Trinidad North ore shoot. The ore shoot remains open to depth and to the north with drilling from underground stations projected to start in early September.

[box type=”note” align=”aligncenter” ]Read more about the San Jose Mine here[/box]

Trinidad North Drilling Highlights:

| Hole_Id | From(m) | To(m) | Interval(m) | Est. True Width(m) | Ag(g/t) | Au(g/t) | Ag Eq(g/t) |

| SJO-299 | 526.00 | 534.00 | 8.00 | 4.7 | 178 | 1.26 | 245 |

| SJO-303A | 462.95 | 470.20 | 7.25 | 5.5 | 258 | 1.45 | 335 |

| SJO-304 | 543.40 | 560.95 | 17.55 | 10.4 | 326 | 2.06 | 436 |

| 580.00 | 593.80 | 13.80 | 8.2 | 487 | 4.00 | 700 | |

| SJO-308 | 503.55 | 511.10 | 7.55 | 4.3 | 226 | 1.28 | 294 |

| SJO-315 | 445.85 | 451.00 | 5.15 | 3.3 | 399 | 2.10 | 511 |

| SJO-321 | 533.75 | 537.75 | 4.00 | 1.5 | 850 | 4.48 | 1,089 |

[box type=”note” align=”aligncenter” ]It is good to see that Fortuna has provided an estimate of the true width (or thickness) of the mineralized zone where intersected by the drill-holes rather than just the drill-hole intervals. This provides any potential investors with a higher degree of confidence in the reported results. Browse to our article on Drill results: apparent versus true thickness for a complete run down on this concept.[/box]

Dr. Thomas I. Vehrs, Vice President of Exploration, commented, “The latest drill results continue to confirm the importance of the Trinidad North discovery. The Trinidad North ore shoot is located proximal to the area of operations at San Jose allowing for development of the zone in 2014 and initiation of production in early 2015. Silver equivalent grades range from 200 g/t to over 2,300 g/t over estimated true vein widths ranging from 2 meters to over 19 meters.” Dr. Vehrs continued, “Underground access is currently in development at the 1300 meter level to allow for continued exploration of the ore shoot to the north and to depths below 1,000 m amsl. The first underground drill station is projected to be ready by the end of August with underground drilling scheduled to begin in early September.”

A summary of the assay results for the principal mineralized intervals in the twelve drill holes is appended to this news release. The reader is referred to the Fortuna Silver news releases of February 4, 2013, April 22, 2013 and May 22, 2013 for the results of previously released drill holes from the Trinidad North zone. Please see the following link to the longitudinal sections for the location of the Trinidad North drill results relative to the existing Mineral Reserves and Mineral Resources of the San Jose Mine: http://www.fortunasilver.com/i/maps/sanjose/Trinidad-deposit-longitudinal-sections_8AUG2013_14AUG13.pdf.

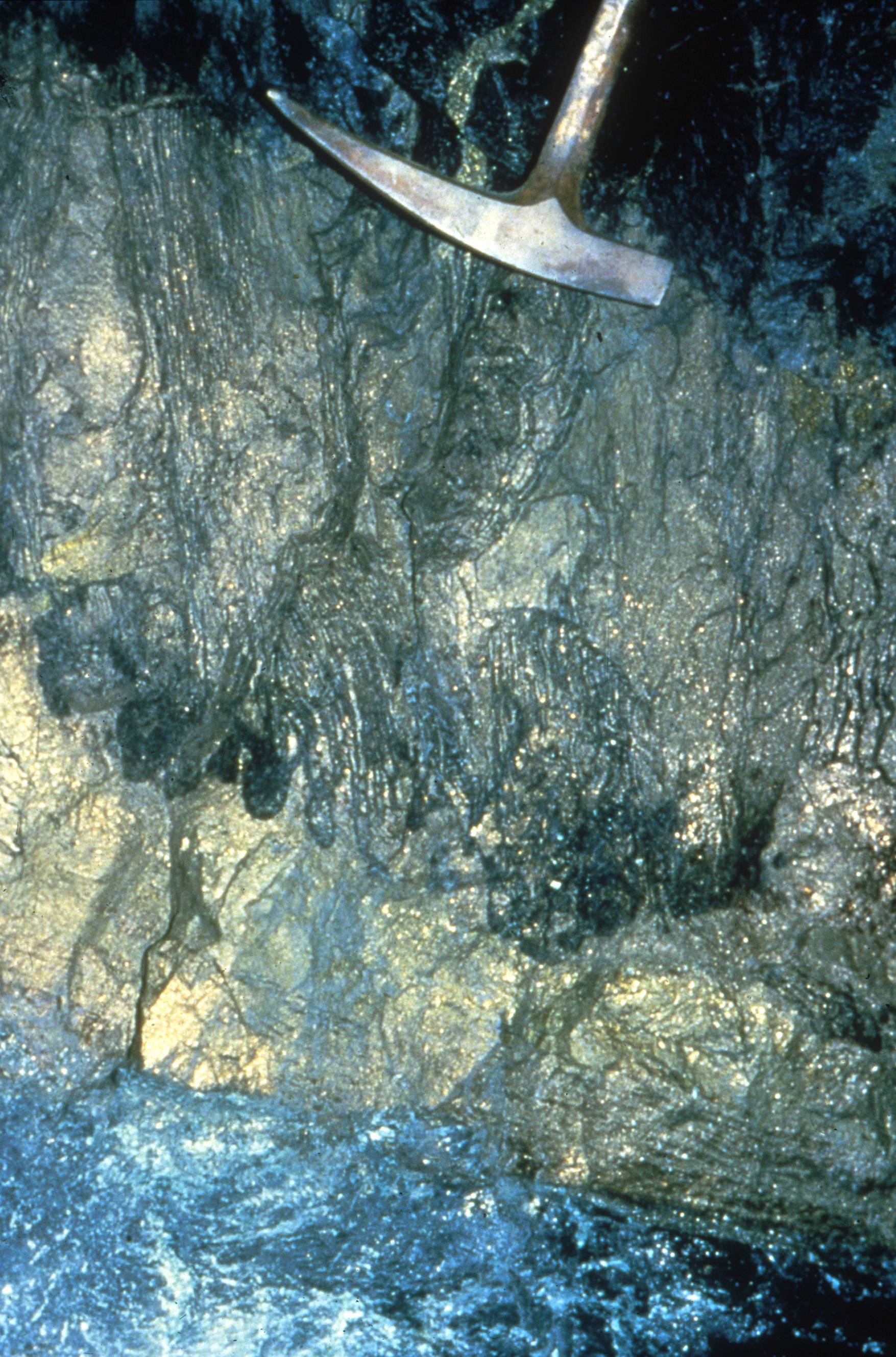

[box type=”note” align=”aligncenter” ]Two of the longitudinal sections are shown below. The Bonanza Vein results look particularly good, especially the thickest parts of the shoot. Some exploration companies would get excited with just the gold results alone, especially if the vein was much closer to the surface. The fairly consistent high silver grades over reasonably thick intervals and nearby underground development makes this area quite attractive. The other longitudinal section is the Trinidad Vein, the results of which are pretty average.[/box]

Quality Assurance & Quality Control

Following detailed geological and geotechnical logging, drill core samples are split on-site by diamond sawing. One-half of the core is submitted to the ALS Chemex Laboratory in Guadalajara, Mexico. The remaining half core is retained on-site for verification and reference purposes. Following preparation, the samples are assayed for gold and silver by standard fire assay methods and for silver and base metals by ICP and atomic absorption methods utilizing aqua regia digestion. The QA-QC program includes the blind insertion of certified reference standards and assay blanks at a frequency of approximately 1 per 15 normal samples as well as the inclusion of duplicate samples for verification of sampling and assay precision levels.

[box type=”note” align=”aligncenter” ]Another “tick” for this company. It looks like Fortuna is on top of its QA/QC, or at least they stated that they do quality control and quality assurance on their laboratory submissions and results. We have an article on QA/QC of geochemical data that is worth a read as it summarises the reasoning behind submitting standards, blanks and duplicates to the laboratory. It also gives the reader an idea of what happens behind the scenes in the exploration office as the results of a QA/QC analysis are not normally put in press releases as they can be quite dull to read and they may even confuse some readers.[/box]

Qualified Person

Thomas I. Vehrs, Ph.D., Vice President of Exploration, is a Qualified Person for Fortuna Silver Mines Inc. as defined by National Instrument 43-101. Dr. Vehrs is a Founding Registered Member of the Society for Mining, Metallurgy, and Exploration, Inc. (SME Registered Member Number 3323430RM) and is responsible for ensuring that the information contained in this news release is an accurate summary of the original reports and data provided to or developed by Fortuna Silver Mines.

[toggle title=”We’ve skipped some of the boilerplate. You can read it in here.” state=”close” ]

Fortuna Silver Mines Inc.

Fortuna is a growth oriented, silver and base metal producer focused on mining opportunities in Latin America. Our primary assets are the Caylloma silver mine in southern Peru and the San Jose silver-gold mine in Mexico. The company is selectively pursuing additional acquisition opportunities. For more information, please visit our website at www.fortunasilver.com.

ON BEHALF OF THE BOARD

Jorge A. Ganoza

President, CEO and Director

Fortuna Silver Mines Inc.

Trading symbols: NYSE: FSM | TSX: FVI | BVL: FVI | Frankfurt: F4S.F

Forward-Looking Statements

This news release contains forward-looking statements which constitute “forward-looking information” within the meaning of applicable Canadian securities legislation and “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements that are not historical facts and that are subject to a variety of risks and uncertainties which could cause actual events or results to differ materially from those reflected in the forward-looking statements. When used in this document, the words such as “anticipates”, “believes”, “plans”, “estimates”, “expects”, “forecasts”, “targets”, “intends”, “advance”, “projects”, “calculates” and similar expressions are forward-looking statements.

The forward-looking statements are based on an assumed set of economic conditions and courses of actions, including estimates of future production levels, expectations regarding mine production costs, expected trends in mineral prices and statements that describe Fortuna’s future plans, objectives or goals. There is a significant risk that actual results will vary, perhaps materially, from results projected depending on such factors as changes in general economic conditions and financial markets, changes in prices for silver and other metals, technological and operational hazards in Fortuna’s mining and mine development activities, risks inherent in mineral exploration, uncertainties inherent in the estimation of mineral reserves, mineral resources, and metal recoveries, the timing and availability of financing, governmental and other approvals, political unrest or instability in countries where Fortuna is active, labor relations and other risk factors.

Although Fortuna has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or information, there may be other factors that cause results to be materially different from those anticipated, described, estimated, assessed or intended. There can be no assurance that any forward-looking statements or information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements or information. Accordingly, readers should not place undue reliance on forward-looking statements or information.

[/toggle]

Assay Results for Principal Mineralized Intervals at the Trinidad North Discovery, Mexico:

| Hole_Id | From (m) |

To (m) | Int (m) |

Est True Width (m) |

Ag (g/t) |

Au (g/t) |

Pb (ppm) |

Zn (ppm) |

Cu (ppm) |

Ag Eq (g/t) |

| SJO-299 | 513.00 | 514.00 | 1.00 | 0.6 | 620 | 4.17 | 542 | 860 | 73 | 843 |

| 526.00 | 534.00 | 8.00 | 4.7 | 178 | 1.26 | 738 | 1246 | 136 | 245 | |

| 536.80 | 544.00 | 7.20 | 4.2 | 102 | 0.74 | 1703 | 3408 | 181 | 141 | |

| SJO-303A | 415.00 | 417.00 | 2.00 | 1.5 | 304 | 3.10 | 62 | 125 | 45 | 469 |

| 455.60 | 459.20 | 3.60 | 2.7 | 168 | 1.10 | 215 | 466 | 24 | 227 | |

| 462.95 | 470.20 | 7.25 | 5.5 | 258 | 1.45 | 365 | 680 | 46 | 335 | |

| SJO-304 | 535.85 | 540.70 | 4.85 | 2.9 | 381 | 1.99 | 829 | 1872 | 127 | 487 |

| 543.40 | 560.95 | 17.55 | 10.4 | 326 | 2.06 | 510 | 1235 | 102 | 436 | |

| 565.00 | 566.50 | 1.50 | 0.9 | 294 | 1.32 | 295 | 791 | 142 | 364 | |

| 572.70 | 575.00 | 2.30 | 1.4 | 249 | 1.86 | 1823 | 4127 | 512 | 348 | |

| 580.00 | 593.80 | 13.80 | 8.2 | 487 | 4.00 | 2121 | 3811 | 401 | 700 | |

| SJO-308 | 475.65 | 477.25 | 1.60 | 0.9 | 655 | 3.66 | 318 | 680 | 60 | 850 |

| 499.50 | 501.70 | 2.20 | 1.3 | 421 | 2.81 | 204 | 377 | 44 | 571 | |

| 503.55 | 511.10 | 7.55 | 4.3 | 226 | 1.28 | 154 | 376 | 38 | 294 | |

| 550.50 | 552.10 | 1.60 | 0.9 | 491 | 4.74 | 1946 | 4696 | 919 | 744 | |

| SJO-310 | 286.90 | 288.00 | 1.10 | 0.6 | 152 | 0.68 | 157 | 184 | 10 | 189 |

| 329.00 | 332.00 | 3.00 | 1.5 | 66 | 0.38 | 166 | 332 | 30 | 86 | |

| SJO-311 | 149.15 | 150.00 | 0.85 | 0.5 | 183 | 6.11 | 7 | 60 | 60 | 509 |

| 429.50 | 431.00 | 1.50 | 0.9 | 825 | 3.74 | 504 | 939 | 47 | 1025 | |

| SJO-313 | 351.00 | 351.50 | 0.50 | 0.3 | 187 | 0.89 | 109 | 342 | 33 | 234 |

| 353.00 | 356.75 | 3.75 | 2.4 | 341 | 1.73 | 312 | 635 | 35 | 433 | |

| SJO-315 | 445.85 | 451.00 | 5.15 | 3.3 | 399 | 2.10 | 327 | 567 | 46 | 511 |

| SJO-316 | 347.30 | 351.00 | 3.70 | 1.4 | 325 | 1.63 | 232 | 262 | 19 | 412 |

| 357.00 | 361.00 | 4.00 | 1.5 | 149 | 0.89 | 175 | 466 | 20 | 196 | |

| 415.50 | 417.55 | 2.05 | 0.8 | 602 | 3.19 | 1377 | 2263 | 59 | 772 | |

| 435.50 | 437.00 | 1.50 | 0.6 | 204 | 1.08 | 397 | 969 | 21 | 262 | |

| 445.90 | 452.20 | 6.30 | 2.4 | 88 | 0.51 | 213 | 465 | 23 | 115 | |

| SJO-320 | No significant mineralized intervals | |||||||||

| SJO-321 | 492.20 | 500.45 | 8.25 | 3.1 | 88 | 0.43 | 900 | 1596 | 104 | 111 |

| 502.10 | 508.80 | 6.70 | 2.5 | 130 | 0.68 | 792 | 1931 | 104 | 166 | |

| 533.75 | 537.75 | 4.00 | 1.5 | 850 | 4.48 | 1076 | 2353 | 78 | 1089 | |

| SJO-325A | 568.10 | 569.60 | 1.50 | 0.7 | 137 | 0.74 | 761 | 1593 | 61 | 176 |

| 573.70 | 575.55 | 1.85 | 0.9 | 181 | 0.78 | 884 | 2368 | 34 | 223 | |

| 606.05 | 607.00 | 0.95 | 0.4 | 111 | 1.48 | 13870 | 27820 | 1373 | 190 | |

*Ag Eq values calculated at Au:Ag ratio of 53.37 based on metal prices as of December 31, 2012 (Au: US$ 1,572.19; Ag: US$29.46), metallurgical recoveries of 89% for both Au and Ag, and a lower cutoff of 70 g/t Ag Eq.

SOURCE Fortuna Silver Mines Inc.

[box type=”note” align=”aligncenter” ]The gold to silver ratio (Au:Ag) continually changes. In the past year it has fluctuated between 67.24 and 50.36. On the 4 September 2013, when this press release review was written, the ratio was 59.47. Therefore, the silver equivalent (Ag Eq) values will continue to fluctuate over time so care needs to be exercised when using these figures for investment decisions. An additional thing to consider are precious metal prices. Gold prices dipped to US$1,200 per oz at the end of June this year. Although regaining some value since then, there is still much uncertainty in future gold prices, with corresponding uncertainty over all precious metals including silver.[/box]

[box type=”success” align=”aligncenter” ]Have a company or release you’d like us to look at? Let us know though our contact page, through Google+, Twitter or Facebook.[/box]