While the basic concept of mining may be familiar to most people, the total process from exploration target to profitable mine is complex and involved. There are a wide range of natural resource types that we extract from the earth and and even wider variety of mining methods.

The key question to be asked is always; is the mine going to make a profit, will revenues exceed the cost of production.

The techniques required to develop a diamond mine are very different from those needed to exploit a base metal deposit. However, there are number of standard steps in the overall process of development of an exploration project to an operating mine.

The key question to be asked is always; is the mine going to make a profit, will revenues exceed the cost of production? Once a potential resource is located, there are many steps required before a mine can be opened. Knowing what stage of the process a company is currently involved in can assist in making sound investment decisions. This information can help a potential investor with timing the investment, or in assessing whether the project is likely to even proceed to actual production within a reasonable time-frame (or in some cases, ever).

There are a few terms to become acquainted with in the world of mining feasibility studies: order of magnitude, pre-feasibility, and feasibility. They range from the lowest level of certainty (order of magnitude) to the highest level of certainty (feasibility), and have increasing levels of detail and expense associated with their completion. We’ll look at each type of study in a bit more detail.

Order of Magnitude (Scoping) Studies

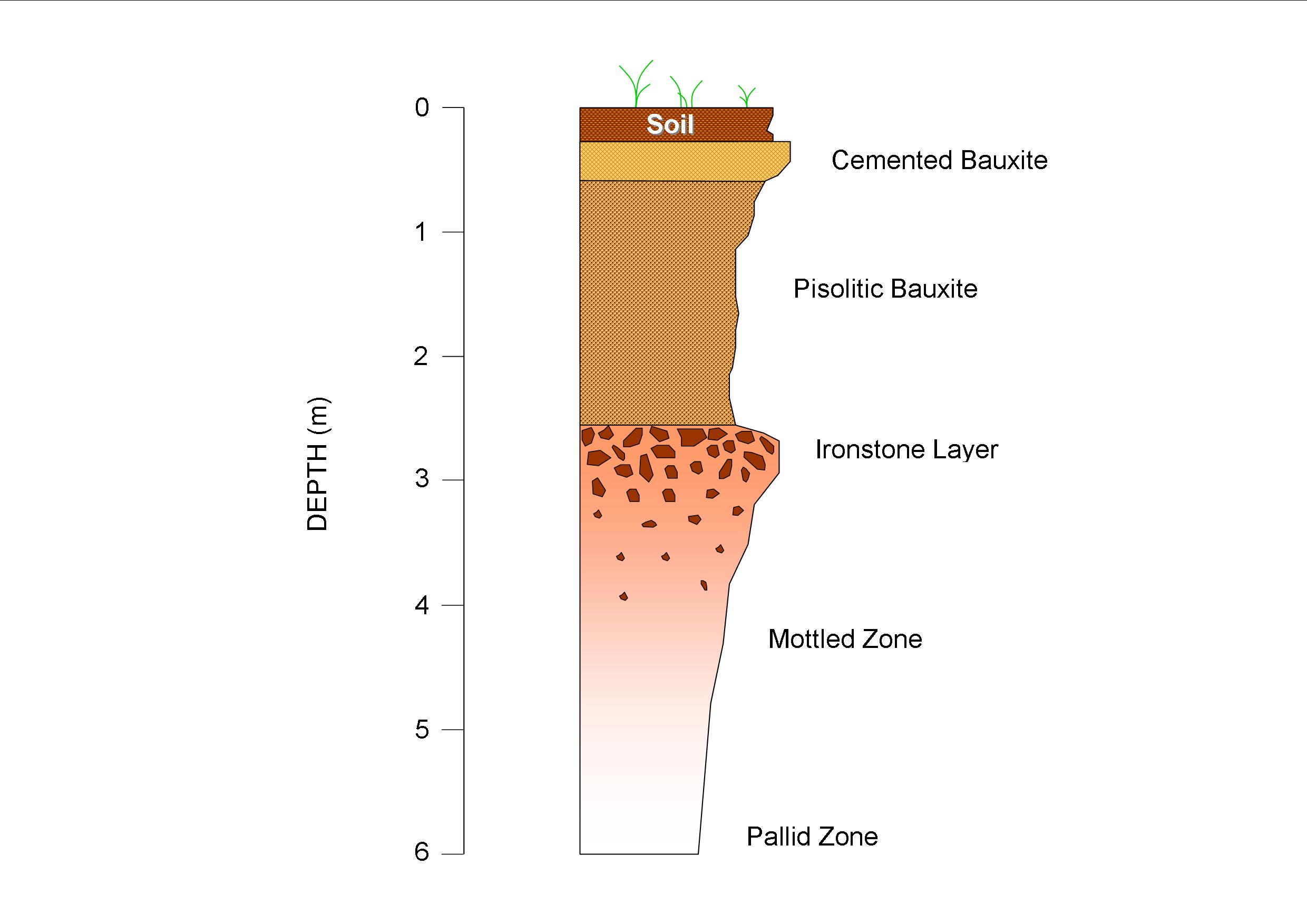

Order of magnitude studies are also known as scoping studies, which is a more descriptive name for what they cover. These studies are designed to delineate the scope of a potential project, including rough estimates of potential production values and costs. When a resource is classified as “indicated”, an order of magnitude or scoping study will provide a financial assessment of the resource.

A key part of a scoping study is the creation of a preliminary mine plan, using software which models the options. There also needs to be decisions made to continue with further engineering work and an exploration drilling program. The basis for these studies are the geology plans from the exploration phase. This allows the individual or team responsible for conducting the study to make reasonable estimates using known costs and likely outcomes. The level of accuracy associated with a scoping or order of magnitude study is between 40-50%.

Preliminary (Pre-Feasibility) Study

The next step on the road to establishing a working mine is the preliminary, or pre-feasibility study. Aspects of this type of study include further exploration drilling program to gain more concrete knowledge about the target ore body, and the adoption of a detailed mine plan and accompanying mining methods that will be best suited for removing the material in a cost effective, timely manner.

Pre-feasibility studies also cover the processing of the material, which can include washing, milling, and numerous other techniques designed to prepare the material for sale and distribution to customers. An effective waste management program will also be designed as part of a pre-feasibility study, which will include ground and waste-water controls, and management of waste, tailings, leach ponds, etc.

The ability to hire, manage, and house staff adequately for the potential mine will also be assessed during this study. Environmental protection, permits (legal and social), and the eventual closure of the mine must all be considered during this phase. Mine access and associated transportation for employees, materials, and equipment typically round out a pre-feasibility study, and these tend to achieve an accuracy within 20-30%.

Full Feasibility Study

The full feasibility study is the final step required to determine if a mine is truly viable, and these are more detailed and costly than the previous two study types. This cost comes largely from the associated engineering work that must be done during the study, as it is complex and time-consuming. Feasibility studies are the basis for raising capital, and the most figures that will be used for budgeting and forecasting come from these studies. Full feasibility studies are significantly more expensive than the other types of studies, and can account for between 0.5-1.5% of a project’s total budget. The level of accuracy increases with this type of study (10-15% of true numbers), which is why the costs rise accordingly.

Typically, projects become hung up during the pre-feasibility stage due to requests for additional information. This is to be expected, as any mine is a large investment with an inherent degree of risk.

Some risks fluctuate based on the type of material that is being mined, as market prices for certain commodities can be volatile. Environmental factors can change, and some may be mitigated while others may not be. Regulations and taxes may also vary depending on the government in charge of the area to be mined, and this can cause a mining climate to go from friendly to inhospitable very quickly. It is important that mining project employ consultants and teams who will fairly and accurately assess the project’s potential without regard for their own continued employment. It is easy to see how this could create a conflict of interest, so consulting teams must be carefully chosen and include experienced project managers and technical staff.

If a project advances successfully through the three typical studies, then the next phase to be completed before construction on the site begins is the detailed design phase. This will not occur unless a mine is going to be built, so barring sudden major funding problems, natural disasters, or political upheaval, your mine is moving forward! An understanding of the full spectrum of information that goes into opening a mine will help investors make informed decisions.

Finally, it is worth noting that for public companies listed on Canadian exchanges, technical reports including resource estimates, pre-feasibility, and feasibility studies need to comply with the NI 43-101 reporting standard.

Subscribe for Email Updates

Pingback: In Search of Diamonds: An Introduction to Kimberlite Exploration | Geology for Investors

Pingback: Canada Strategic Metals Reports Get Expected Results from Sakami | Geology for Investors